Change Store Email Addresses - Mageplaza

How to Import Export Tax Rates in Magento 2

Vinh Jacker | 08-24-2016

Managing tax rates is an essential part of running an e-commerce store. If you’re operating in multiple regions, configuring tax rates manually can be time-consuming and prone to errors. Thankfully, Magento 2 provides built-in functionality to import and export tax rates easily, saving you hours of manual work and ensuring tax compliance across locations.

In this guide, we’ll walk you through everything you need to know about Magento 2 tax rates and show you step-by-step how to import and export tax rates efficiently.

What Are Magento 2 Tax Rates?

Magento 2 tax rates are predefined rules that determine how much tax is applied to products based on specific conditions such as the customer’s location, product type, or tax class. They are a fundamental part of Magento’s flexible tax configuration system.

Each tax rate in Magento 2 is associated with:

- Country

- State/Region

- ZIP/Postal Code

- Rate Percentage

- Tax Identifier (Code)

These tax rates ensure that the correct amount of tax is applied at checkout based on customer location and legal tax requirements.

For store owners who sell to multiple countries or states, managing tax rates manually can be complex and time-consuming. This is why Magento 2 offers a tax rate import and export feature that simplifies the process.

Why Should You Import & Export Tax Rates in Magento 2?

Using the Magento 2 import tax rates and Magento 2 export tax rates feature brings significant advantages:

Save time & effort

Manually configuring dozens or hundreds of tax rates in the admin panel is not practical. Importing and exporting allows you to manage them in bulk.

Ensure accuracy

Handling tax rates in a CSV file reduces the chance of manual entry mistakes and misconfigurations.

Easy migration & backup

You can easily transfer tax rates between different Magento installations or simply back them up before making major changes.

Comply with tax law updates

If local tax rates change, you can quickly update your store’s tax rates using the import feature without editing each rate manually.

How to Import & Export Tax Rates in Magento 2

Magento 2 provides built-in options to import and export tax rates directly from the admin panel. Below is a detailed step-by-step guide:

How to import tax rates in Magento 2

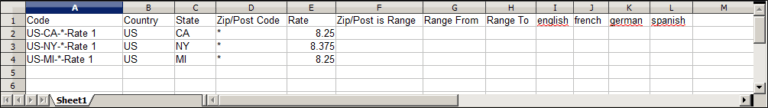

Step 1: Prepare your CSV file

You can use the file exported earlier as a template. The CSV file should contain the following columns:

- Country

- Region/State

- Rate Percentage

- Tax Identifier

- ZIP/Postcode From (optional)

- ZIP/Postcode To (optional)

Ensure that:

- The file format is CSV.

- No required fields are left empty.

- There are no duplicate tax rate entries.

Step 2: Import the tax rates

- Log in to your Magento 2 Admin Panel.

- Navigate to Stores > Taxes > Tax Zones and Rates.

- Click Import Tax Rates in the top-right corner.

- Click Choose File and select your prepared CSV file.

- Click Import Tax Rates to complete the process.

Magento 2 will automatically upload the tax rates and apply them across your store.

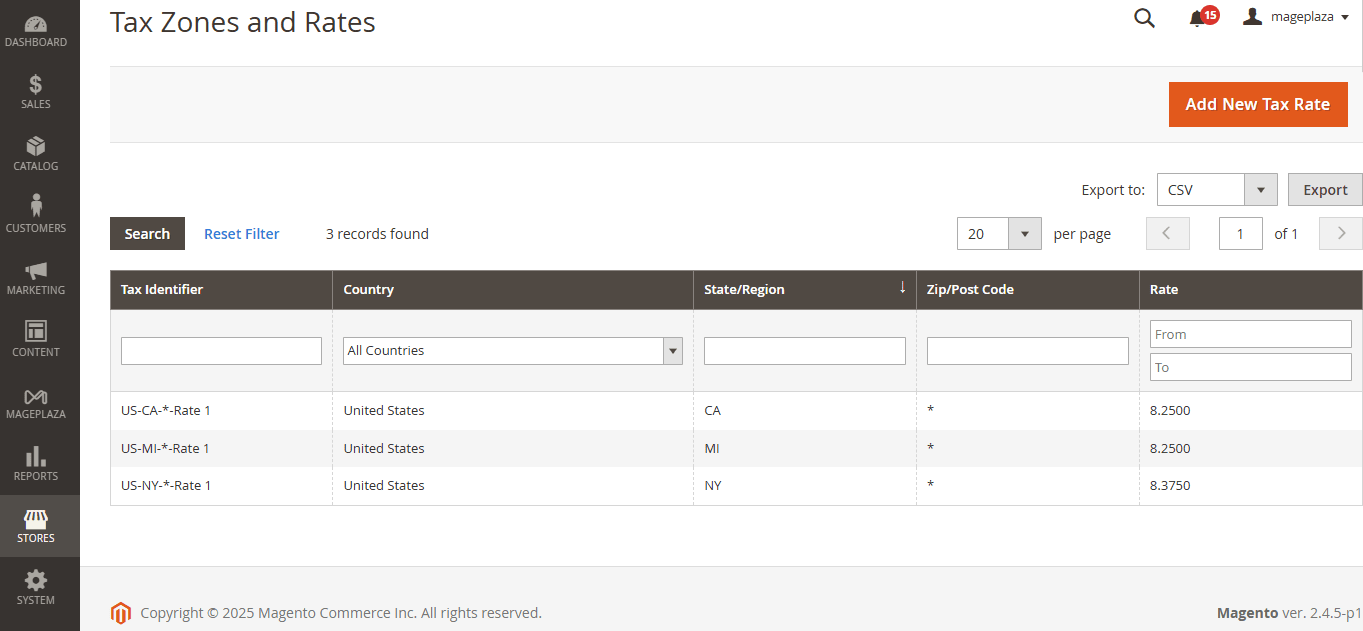

How to export tax rates in Magento 2

If you want to backup your existing tax rates or move them to another Magento store, follow these steps:

Step 1: Access the Tax Rate Export Section

- Log in to your Magento 2 Admin Panel.

- Go to Stores > Taxes > Tax Zones and Rates.

- In the upper-right corner, click Export Tax Rates.

Step 2: Download the Tax Rates File

- Magento will generate a CSV file containing all existing tax rates.

- Save the CSV file to your local computer. You can use it for backup purposes or edit it before re-importing.

Pro tip: Always keep a copy of your exported tax rates before making bulk changes to avoid accidental data loss.

Common Errors When Importing Tax Rates (And How to Avoid Them)

To ensure a smooth import process, avoid these common mistakes:

- Incorrect file format: Always use a CSV file with the correct column structure.

- Duplicate entries: Clean up the CSV file to avoid duplicate tax rates.

- Missing required fields: Ensure that all mandatory columns (Country, Region, Rate, Identifier) are properly filled.

- Incorrect ZIP/Postcode range format: Follow the correct syntax if you’re using postcode ranges.

Best Practices for Managing Magento 2 Tax Rates

To effectively manage tax rates in Magento 2, follow these best practices:

- Always export tax rates before making bulk changes.

- Use a spreadsheet to clean and organize tax rate data.

- Test imported tax rates on a staging site before applying them live.

- Regularly back up your Magento 2 tax rates configuration.

- Stay updated on tax law changes and adjust tax rates accordingly.

Final Words

Properly managing tax rates is vital for any eCommerce store’s compliance and customer trust. Magento 2 makes it easy to import and export tax rates so you can manage them in bulk without hassle.

By following the steps in this guide, you can streamline your tax rate management process, avoid manual errors, and ensure tax regulations are correctly applied across all your store locations.

If you need further assistance with Magento 2 tax rate setup or other store configurations, feel free to reach out to our team.

Related Post