Change Store Email Addresses - Mageplaza

How to Configure US Tax in Magento 2

Vinh Jacker | 06-30-2016

How to Configure US Tax is one of the examples we want to give you after learning about tax rules and tax rates in Magento 2. If your store is operating in the US, this tutorial would be helpful for you. In this topic, I will give you the detailed instruction of the US tax configuration that surely helps the tax rules and rate apply for your tax in the correct way.

In addition to US Tax, you also have certain examples about Canada Tax and EU Tax. Follow these links to get a deeper study about the tax rules and rates configuration on Magento 2 stores.

Steps to Configure US Tax in Magento 2

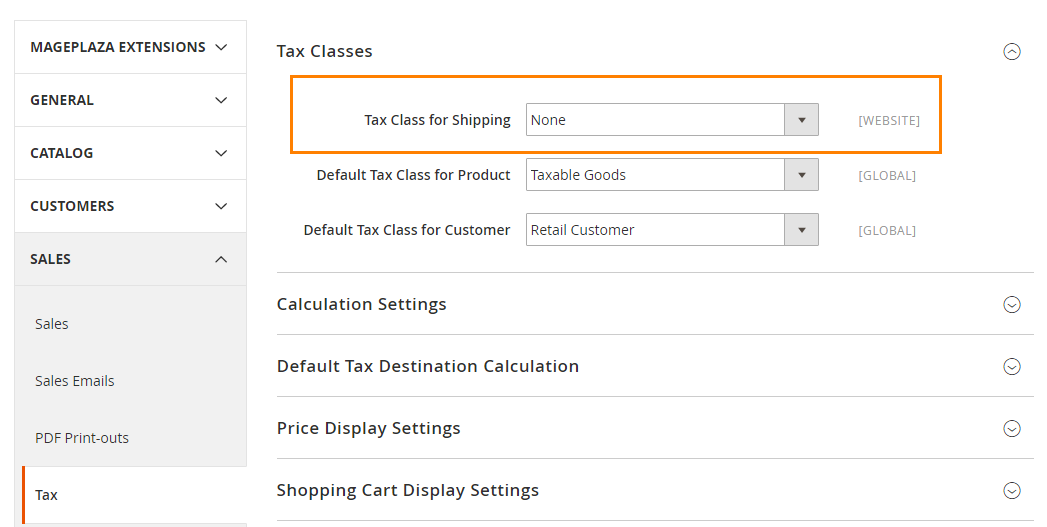

- On the Admin Panel,

Stores > Settings > Configuration. - On the left panel, under

Sales, chooseTax. - Open the

Tax Classessection, set theTax Class for Shippingto “None”.

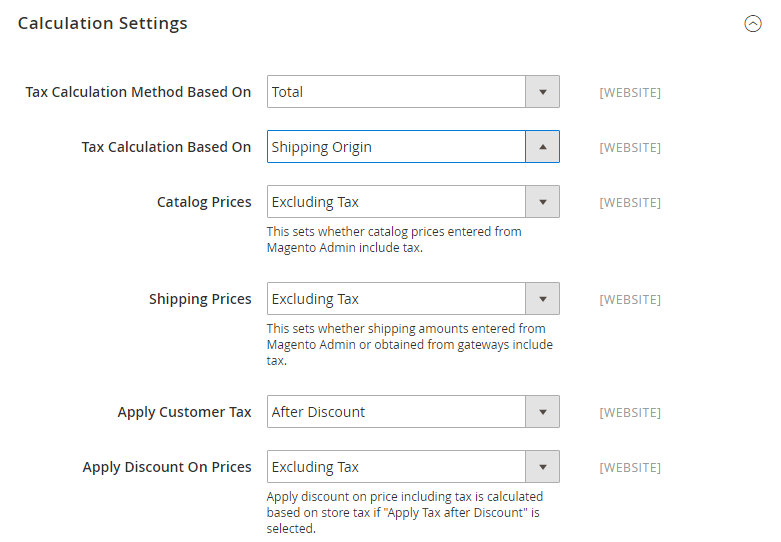

- Scroll down to the Calculation Settings section,

- In the

Tax Calculation Method Based Onfield, allow calculating the tax on the “Total” value of the order. - Choose the “Shipping Origin” option for the

Tax Calculation Based Onfield. - “Excluding Tax” from the

Catalog PricesandShipping Priceswhen setting up US Tax. - Allow the US tax include the discount amount by choosing “After Discount” in the

Apply Customer Taxfield. - “Excuding Tax” from the discount value in the

Apply Discount on Pricesfield.

- In the

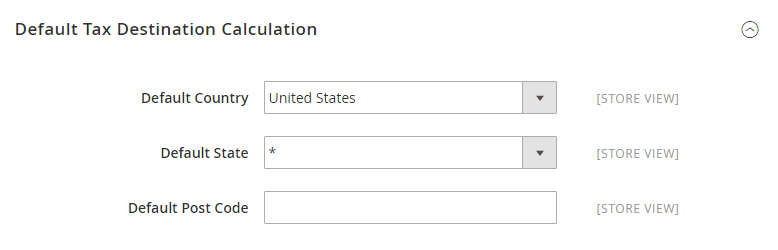

- Expand the Default Tax Destination Calculation section,

- Set the

Default Countryto “United States”. - Set

Default Stateto where business is located”. - Set

Default Post Codeto the number range according to the state you set.

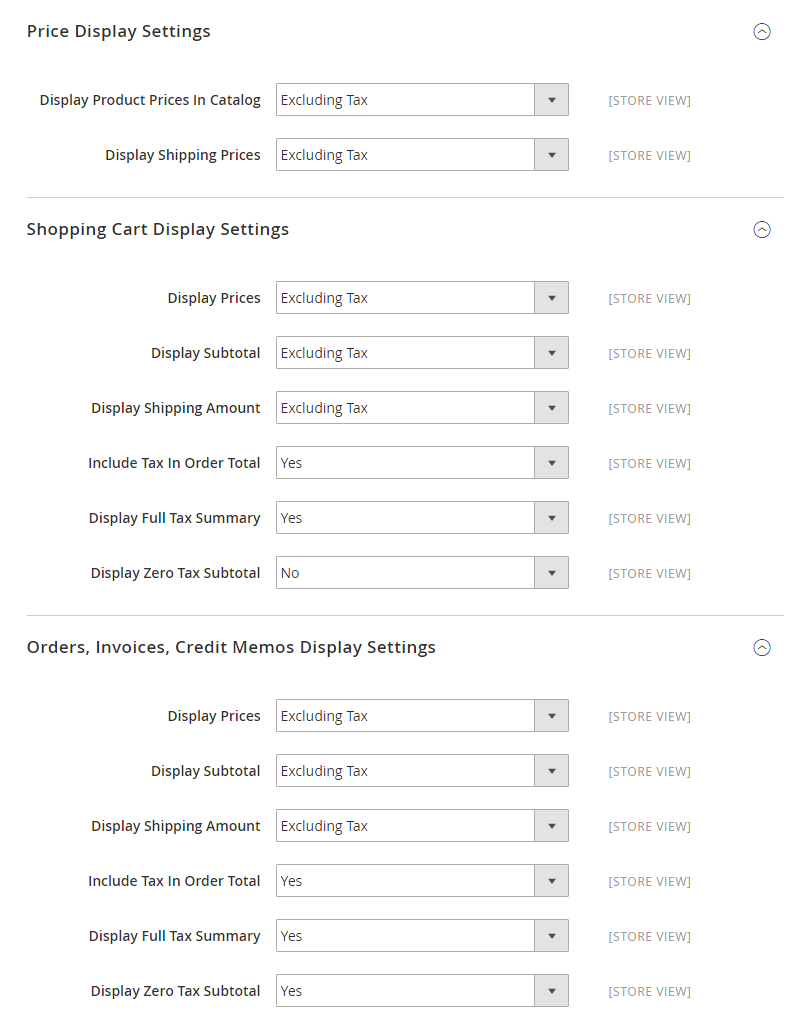

- Set the

- In the Price Display Settings workplace, “Excluding Tax” from the

Display Product Prices in CatalogandDisplay Shipping Prices. - Open the Shopping Cart Display Settings workplace,

- “Excluding Tax” from the display of

Prices,Subtotal,Shipping Amount,Gift Wrapping Prices, andPrinted Card Prices. - Set

Include Tax in Grand Totalto “Yes”. - Set

Display Full Tax Summaryto “Yes”. - Set

Display Zero Tax Subtotalto “Yes”.

- “Excluding Tax” from the display of

- Expand Orders, Invoices, Credit Memos, Display Settings section:

- “Excluding Tax” from the display of

Prices,Subtotal, andShipping Amount. - Set

Include Tax in Grand Totalto “Yes”. - Set

Display Full Tax Summaryto “Yes”. - Set

Display Zero Tax Subtotalto “Yes”.

- “Excluding Tax” from the display of

- In the

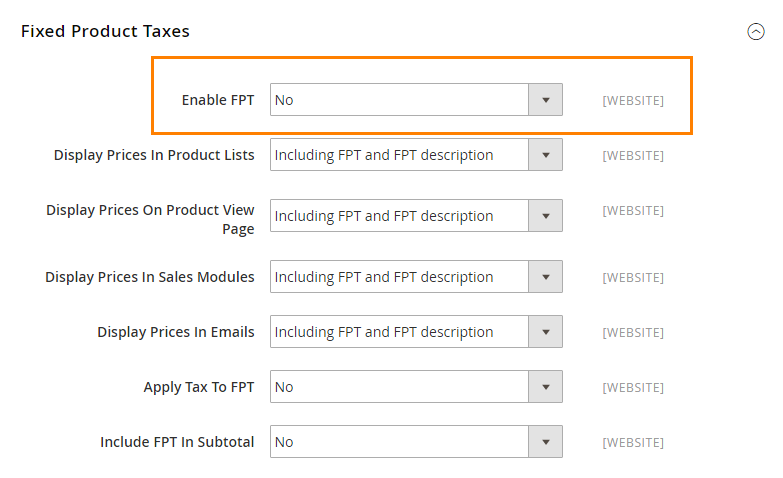

Fixed Product Taxesworkplace, to approve the US tax, choose “No” forEnable FPTfield.

The bottom line

That’s all for today. If you want to run your business in the US market, make sure to configure US Tax now. And in case you want to learn more about other tax-related topics, please click on the links below. Don’t hesitate to contact us for more guidance if you need.

Related Post