Hyvä Theme is Now Open Source: What This Means for Magento Community - Mageplaza

Hyvä is now Open Source and free. Discover what changed, what remains commercial, how it impacts the Magento ecosystem, and how to maximize its full potential.

The efficiency level of running an e-commerce store can be measured by how customers are satisfied with the support they get during their customer journey. And a smooth check-out manipulation will surely guarantee customers an enjoyable experience in the very last step of this process. A superior check-out experience should come down with a proper payment gateway to make final transactions seamless for both companies and clients. In fact, some survey analytics have proven the utmost importance of payment types in determining customers’ final purchase decisions.

What challenges e-commerce store owners is to wisely select the optimal payment gateway integration for their stores from a wide variety of alternatives on the market. Thorough consideration from different angles and aspects is highly recommended to help stores opt for the best Magento 2 payment gateways among other multiple options.

An e-commerce payment gateway can be simply understood as a merchant service allowing credit card payment in an online store’s existing software. It helps process transactions directly from e-commerce businesses or online stores to the payment processor who later receives money from the customers. The payment gateway can be provided by the bank to its customers, but the certified financial service providers can also supply it as a separate service.

With a payment gateway, customers can easily submit their credit card data with security validation. And this financial information can be transferred between the merchants’ payment portal and the acquiring bank.

eCommerce payment gateway functions in a closed process that prioritizes customer data privacy and transfer authentication.

The process starts with the customers’ desired purchase selection and order confirmation by submitting their credit bureau deceased card data on the final checkout page. Once the submission click is finished, the Magento payment gateway will automatically receive the transaction information and encode payment details.

These payment details will then be delivered to the payment processor. The transaction is then directed to the issuing bank to request transaction authentication. Whether the request is approved or declined by the issuing bank (depending on the margins in the customer’s bank account), a response will be sent back to the payment processor. And once the customers receive the response, the transaction processing cycle is completed.

After the bank sends the money through the payment gateway, the payment gateway will send the money to the merchant account. It can be sent in a few minutes or as long as 21 working days depending on the functioning payment gateway.

First, it’s crucial to consider the market you’re serving. Different regions have varying preferences for payment methods. For instance, in Vietnam, VNPay and OnePay are common, while in Canada, options like WorldPay and Moneris are widely used. Understanding the preferred payment options in your target market ensures customer convenience and satisfaction.

Security and compliance are the next things to consider. The gateway must adhere to Payment Card Industry Data Security Standards (PCI DSS) to ensure that credit card data is processed securely. SSL encryption is also necessary to protect transaction data. A PCI DSS-compliant gateway assures customers that their payment information is secure and reduces the risk of data breaches, which can harm both your reputation and business operations.

Next, you should think about the ease of integration with Magento 2. A payment gateway should integrate smoothly into the Magento 2 platform, from installation and configuration to daily transaction management.

Technically, the gateway must be compatible with the Magento 2 architecture. This includes supporting the latest Magento versions, following Magento’s coding standards, and being able to work alongside other extensions or customizations in the store. A compatible payment gateway reduces the risk of conflicts that could affect store performance or user experience.

The integration process should be straightforward, allowing store owners or administrators to easily configure payment methods, set transaction fees, manage currencies, and customize other settings without needing extensive technical expertise. Additionally, the gateway should offer efficient management tools like dashboards or reporting features. These tools integrate seamlessly with Magento’s backend so that you can monitor transactions and manage payments more effectively.

Transaction fees and payment structures directly impact your store’s profitability. Fees vary based on transaction types, payment methods, and volume. It’s important to understand how fees are charged—whether flat-rate, percentage-based, or a mix—and consider differences between domestic and international transactions. Choose a gateway with competitive fees to maintain healthy profit margins while ensuring reliable service.

Also, consider whether your payment gateway supports popular mobile payment systems like Apple Pay and Google Pay. These platforms offer speed, security, and ease of use, enabling customers to make quick transactions without entering card details. Supporting these payment options caters to customer preferences and enhances your store’s reputation as modern and customer-focused.

Additionally, mobile payment options can improve conversion rates by reducing cart abandonment. With mobile commerce on the rise, offering Apple Pay and Google Pay is essential, especially for reaching tech-savvy, younger consumers.

The payment gateway’s user experience should be seamless and intuitive to reduce cart abandonment. It’s much better if the process is straightforward from purchase to payment completion.

If your business operates internationally and serves customers across multiple countries, it’s crucial to choose a payment gateway that supports various currencies. Customers prefer shopping on websites that offer localized payment options, as it saves them the hassle of converting currencies. By ensuring your gateway supports multiple currencies, you can improve the shopper experience, gain their trust, and reduce cart abandonment.

Read more: Configure Currency in Magento 2

Customer support and gateway reliability are crucial for smooth operations. A responsive support system, offering live chat, email, and phone support, is essential in case of issues such as transaction failures or fraud detection. Additionally, choosing a gateway with high uptime and reliable processing ensures that transactions are completed without disruption, minimizing lost sales and maintaining trust.

Braintree is a payment processing company that helps businesses accept payments online and through mobile apps. It’s owned by PayPal and acts as a merchant account, allowing you to accept various payment methods from your customers in a secure way. Braintree provides a suite of features to streamline the payment process for both you and your customers. These include a checkout interface, customer data storage for faster checkouts, and fraud prevention tools.

The payment options that Braintree offers:

Transaction fee:

Pros:

Cons:

Authorize.net is a prominent company in the payment services sector, streamlining electronic and credit card payments. It ranks among the top Magento 2 payment gateways, offering straightforward integration, especially with the Magento 2 Authorize.net CIM extension.

It offers a range of features including seamless integration with websites and applications, robust security measures, support for various payment methods, and tools for managing recurring payments and subscriptions. Additionally, Authorize.net provides extensive documentation and customer support to assist businesses in setting up and optimizing their payment processes.

The payment options that Authorize.net offers:

Transaction fee:

All-in-one

Payment gateway and eCheck:

Payment gateway

Pros:

Cons:

When it comes to secure payment, PayPal is an irreplaceable top-pick solution for both clients and store owners. Its reputation in the market has been undoubtedly proven by gaining trust of over 400 million active customers and 30 million merchants.

This method appeals to users for several reasons. PayPal offers free registration to PayPal accounts and free download of the PayPal app. The PayPal accounts allow direct connection with the bank accounts, enabling customers to pay for their online purchases from any devices without using credit cards. The financial security factors are prioritized for customers in the checkout step since sellers will only receive the PayPal account number, not a bank account or credit card number. With PayPal payment gateway, buyers can also make purchases from different currencies without worrying about currency converting.

Transaction fee: Distinct transaction charges apply to domestic and international transactions.

The payment options that Paypal offers:

Pros:

Cons:

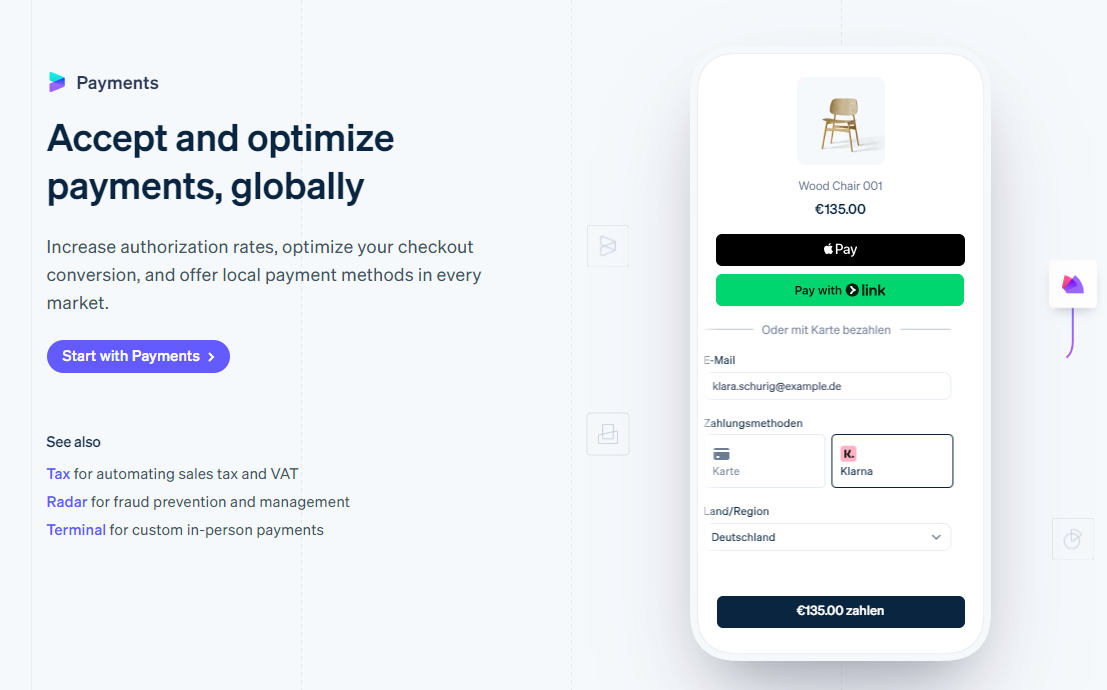

Another big name from the payment gateway competition that can compete with PayPal is Stripe. Stripe, a payment company in Australia launched in 2011, has been delivering optimal payment services that support over multi-currency from 46 different countries without having to set up separate merchant facilities.

The gateway offers several outstanding features to gain its deserving position in the market. One of the major benefits is the availability to stay on-site, other than being directed to different sites, during payment. Especially, there are surprisingly no extra fees charged in Stripe integration, from monthly fees, set up fees, minimum charges or card storage fees - everything is made easy and prior to users.

Transaction fee: 2.9% + 30 cents per card transaction

The payment options that Stripe offers:

Pros:

Cons:

The Magento 2 Stripe extension is the number one recommendation by Mageplaza for global Magento 2 sellers and merchants to integrate into their e-commerce stores.

Opayo, previously SagePay, is a top payment gateway trusted by businesses globally. It offers secure payment processing services for online, in-store, and phone transactions. With support for major cards and alternative methods like PayPal, it ensures smooth transactions. Its strong security, including PCI DSS compliance, safeguards against fraud.

Opayo seamlessly integrates with popular e-commerce platforms like WooCommerce and Shopify, simplifying setup for merchants. Additionally, it offers advanced reporting tools for insights into sales performance and customer behavior, aiding business growth.

Specifically, with Magento 2 SagePay extension, stores are offered with the customizable payment processes and interfaces by selecting these 3 integration options: SagePay Direct, SagePay Form, and SagePay Server. This feature allows more opportunities for stores to properly select a suitable integration method for implementation.

Transaction fee:

The payment options that Opayo offers:

Pros:

Cons:

CartaSi provides great payment services to financial or institutional companies and e-Commerce stores in the Italian market. CartaSi has earned a leading position in electronic money, with 2 billion transactions and a total of 13 million credit cards in circulation. Over 17 million of Italian customers have been persuaded to make regular online products and services through CartaSi.

The integration of CartaSi payment to Magento 2 stores offers unlimited benefits to both store administrators and customers.

This extension offers significant benefits, including refund availability, data security, and minimizing chargebacks through the 3D Secure feature. It primarily focuses on qualifying CartaSi payments based on order quantity conditions. Store admins can specify minimum and maximum order limits for customers. When customers reach these limits, the extension suggests and displays a new CartaSi payment method. For businesses targeting the Italian market, it’s essential to consider integrating this CartaSi payment extension, conveniently available in Mageplaza, into their Magento stores.

Transaction Fee: Vary depending on factors such as the type of merchant account, the volume of transactions, and the specific agreement with the payment processor.

The payment options that CartaSi offers:

CartaSi doesn’t function as a standalone payment method with multiple choices. Instead, it acts as a network facilitating specific card transactions. Here’s how it works:

For transactions involving MasterCard and Visa: CartaSi enables the use of Italian-issued MasterCard and Visa credit or debit cards. Therefore, the payment options available through CartaSi are essentially those provided by Visa or Mastercard.

Regarding installment plans: CartaSi frequently offers the option for installment plans on purchases, particularly for higher-value transactions. However, this feature is typically provided by the issuing bank rather than directly by CartaSi.

Pros:

Cons:

WorldPay (Pay360) is a widely recognized merchant service provider, serving over 400,000 merchants in 146 countries worldwide. It handles more than 150 million transactions annually, thanks to its exceptional features.

For customers, WorldPay (Pay360) offers convenient payment options such as the Virtual Terminal and pay-per-link features. These allow customers to pay without leaving the website, either by entering their card details on the WorldPay-hosted payment page or through integrated payment extensions. The payment details are securely sent to the payment gateway for authorization.

Besides customers, merchants can also benefit from WorldPay (Pay360) integration. This payment gateway is adaptive to any business sizes and shapes in equipping with optimal manager tools to help businesses keep track of transaction information as well as insights and key reports. In addition, merchants don’t even have to worry about security since WorldPay is here to offer an upgraded fraud protection system.

Especially, Magento 2 stores can enjoy many other prominent payment features when integrating a Magento 2 WorldPay Pay360) payment extension to their stores, such as WorldPay eWallets payment, Worldpay local card schemes payment, Worldpay vault for card saving and admin order

Transaction Fee: From 0.75% to 2.75%

The payment options that WorldPay offers:

Pros:

Cons:

CommWeb is a payment gateway from the Commonwealth Bank of Australia (CBA). It’s made for Magento 2 to securely process online payments for businesses. It offers various payment choices and is a top pick in Australia. Adding CommWeb to websites can enhance conversions and sales.

For the Magento 2 Commonwealth Bank CommWeb, this gateway accepts the most popular cards over the world such as Visa, Mastercard, JCB, or American Express. It also secures online transactions with an internal risk management system and CVN (Card Verification Numbers) verification. Besides, owners can create their own signature for online stores with 3 display types on the Checkout page.

In addition, the CommWeb extension for Magento 2 also provides a simple integration process. Because every configuration step is easy and time-saving, the store administrators do not need any complex connection mechanism. With its robust feature set and benefits, CommWeb stands as a reliable choice for businesses seeking an efficient and secure payment gateway integration with Magento 2.

Transaction Fee:

The transaction fee for the CommWeb payment gateway varies based on factors such as the type of merchant account, transaction volume, and specific agreement with the Commonwealth Bank of Australia (CBA). Their relationship manager will talk you through the fees and costs.

The payment options that CommWeb offers:

Pros:

Cons:

Barclaycard is a financial services company with a presence in both the UK and US. They offer a variety of credit cards, with options to earn cashback rewards, travel points, or 0% interest on purchases and balance transfers. You can manage your account and make payments online, through their mobile app, or by phone.

Whether you’re looking for a card for everyday spending or travel hacking, Barclaycard might be a good option to consider. Their website offers details on their various credit card offerings and features, allowing you to compare and choose the card that best suits your needs.

Transaction Fee:

Barclaycard transaction fees hinge on two primary factors: the transaction type and whether it’s conducted internationally.

For foreign transactions, a 2.99% fee applies to any non-Sterling transactions, encompassing purchases, cash withdrawals, and online shopping on non-UK websites. This fee applies to both debit and credit cards, unless you possess a card with fee-free foreign transactions. Additionally, there’s a minimum £2.99 fee for cash withdrawals abroad.

For cash advances, a flat £2.99 fee is charged for withdrawals under £100, while a 2.99% fee applies for amounts exceeding £100.

The payment options that Barclaycard offers:

Pros:

Cons:

Sharing the same opinion about secure online payment, Mageplaza created Barclaycard Payment extension of Mageplaza as a method for Magento 2 store owners to establish a secure system, eliminating any risks in payments. Particularly, the Mageplaza Magento 2 payment gateway offers high security for shopping with multiple security layers to ensure that transactions are safe. Especially, this design is considered an effective strategy for stores whose customers are mainly in the UK. The option of using a comfortable and familiar payment gateway will encourage customers to increase their spending.

2Checkout has gained trust from over 50,000 merchants all over the world and accepts a diversity of payment methods and currencies to ease customers’ checkout process. This payment gateway comes with over 300 fraud rules, with its service getting recognized with several standards such as PCI DSS level 1, GDPR, BBB Accreditation, ISAE 3402 and SSAE 18, Privacy Shield to ensure high security.

Transaction Fee:

The payment options that 2Checkout offers:

2Checkout offers various payment options, including credit and debit cards, PayPal, Apple Pay, Google Pay, and other localized payment methods based on the customer’s location.

Now that we have covered the 9 most amazing payment methods for Magento 2 platform, let’s get into the way to integrate one of them into your website. Actually, the integration process may vary depending on the specific payment gateway provider you choose, but here are the general steps to integrate a payment gateway into your website

Because each method will have different benefits and extensions, we recommend customers consider carefully before making the decision to avoid unworthy spending for an unsuitable gateway.

Sign up for an account with the chosen payment gateway provider. This usually involves providing your business and banking information.

Once you have an account, the payment gateway provider will provide you with API credentials, including a unique merchant ID, API keys, and other necessary information. These credentials are required to connect your website to the payment gateway.

Familiarize yourself with the security requirements of the payment gateway. Ensure your website is equipped with SSL/TLS encryption to secure customer data and comply with Payment Card Industry Data Security Standard (PCI DSS) guidelines.

After the 4 above steps, you have to decide on the integration method that best suits your website’s needs. The common options are:

If you choose API integration, you need to develop or install the necessary code to connect your website to the payment gateway. Most payment gateway providers offer developer documentation and code samples to assist you. Follow their integration guides and implement the required code snippets on your website.

Before going live, thoroughly test the payment gateway integration. Make test transactions using different payment methods and scenarios to ensure everything works smoothly.

Once testing is complete and you are confident in the integration’s functionality, switch to the live mode in your payment gateway account. Update any necessary configurations or settings to start processing real transactions.

Online payment has been a great advancement in digital trading, making checkout easier than ever. The application of an ultimate payment gateway can help accelerate the checkout and money transferring process between merchants and their customers. Magento 2 stores should consider integrating a Magento payment gateway extension to enjoy a full-package payment gateway’s feature list as well as the extra features only Magento extensions offer.