4 Best E-commerce Accounting Software Programs for 2023

In the ever-evolving world of e-commerce, the year 2023 promises to be a pivotal time for businesses seeking efficient and effective ways to manage their finances. As the backbone of any successful online enterprise, eCommerce accounting software plays a crucial role in ensuring financial transparency, accuracy, and growth.

Trust in a small business, just like trust in any other entity, depends on a variety of factors. While the size of a business can be one consideration, it should not be the sole determinant of trustworthiness. Here are some factors to consider when evaluating whether you can trust a small business:

- Reputation: Look at the business’s reputation, both online and through word-of-mouth. Customer reviews and testimonials can provide valuable insights into the quality of their products or services and their overall reliability.

- Experience and expertise: Assess the experience and expertise of the business owners and staff. A small business with knowledgeable and skilled professionals is more likely to deliver on its promises.

- Transparency: Transparency is key to trust. A trustworthy small business should be open and honest about its products, services, pricing, and policies. They should readily provide information when asked and address any concerns or questions.

- Legal compliance: Ensure that the small business operates within the legal framework of your region. Verify that they have the necessary licenses and permits, adhere to regulations, and follow ethical business practices.

- Customer service: Good customer service is a hallmark of a trustworthy business. Consider the responsiveness of the business to your inquiries, their willingness to resolve issues, and their overall customer service approach.

User Experience Solutions for Magento 2

Significantly improve shopping experience for your online store- References: Ask the business for references from previous customers or clients. Contacting these references can provide additional insights into their trustworthiness.

- Financial stability: Assess the financial stability of the business. A small business that manages its finances well is more likely to fulfill its commitments and stay in business for the long term.

- Contracts and agreements: When entering into agreements with a small business, carefully review contracts and agreements. Ensure that all terms and conditions are clear and reasonable, and seek legal advice if necessary.

- Guarantees and warranties: Check if the business offers any guarantees or warranties for their products or services. These can provide added assurance of their commitment to quality.

- Local presence: Being a part of the local community can also enhance trust in a small business. A business that is engaged with its community and has a physical presence may be more accountable.

How to select the best eCommerce accounting software selection criteria?

Selecting the best e-commerce accounting software is crucial for managing your online business’s finances effectively. To make an informed choice, consider the following selection criteria:

Core functionality

- Accounting essentials: Ensure the software covers fundamental accounting functions such as income and expense tracking, invoicing, accounts payable/receivable, bank reconciliation, and financial reporting.

- Inventory management: If you sell physical products, the software should have robust inventory management capabilities to help you track stock levels, costs, and sales.

- Tax management: Look for features that can help you calculate, collect, and file taxes, including support for different tax rates and regions.

- Multi-currency support: If you operate in multiple currencies, the software should handle currency conversion and foreign exchange transactions accurately.

Key features

- Financial reports: The software should generate essential financial reports, such as profit and loss statements, balance sheets, and cash flow statements.

- Automation: Evaluate automation features like recurring invoices, expense categorization, and bank feeds that save you time and reduce manual data entry.

- Data security: Ensure the software provides robust data security measures, including data encryption and regular backups, to protect your financial information.

- Scalability: Consider whether the software can grow with your business, accommodating increased transaction volumes and additional users or features as needed.

- Mobile accessibility: Mobile apps or responsive web design can be beneficial for managing your finances on the go.

Usability

- User interface: Choose software with an intuitive, user-friendly interface that makes it easy to navigate and perform tasks.

- Customer support: Assess the availability and quality of customer support options, including phone, email, live chat, or a knowledge base for self-help.

- User training: Check if the software offers resources like tutorials, guides, or training sessions to help you and your team become proficient users.

Software Integrations

- Ensure the software can seamlessly integrate with your existing ecommerce platforms, payment gateways, and other tools (e.g., CRM software, inventory management systems).

- Third-party integrations can enhance your accounting software’s functionality and streamline your business processes.

Value for Price

- Evaluate the software’s pricing structure, considering factors such as monthly or annual subscription costs, scalability, and any additional fees.

- Compare the features and functionality offered at different price points to determine the best value for your specific needs.

- Look for free trials or demo versions to test the software before committing to a subscription.

Best eCommerce accounting software

1. QuickBooks online: Best overall eCommerce accounting software

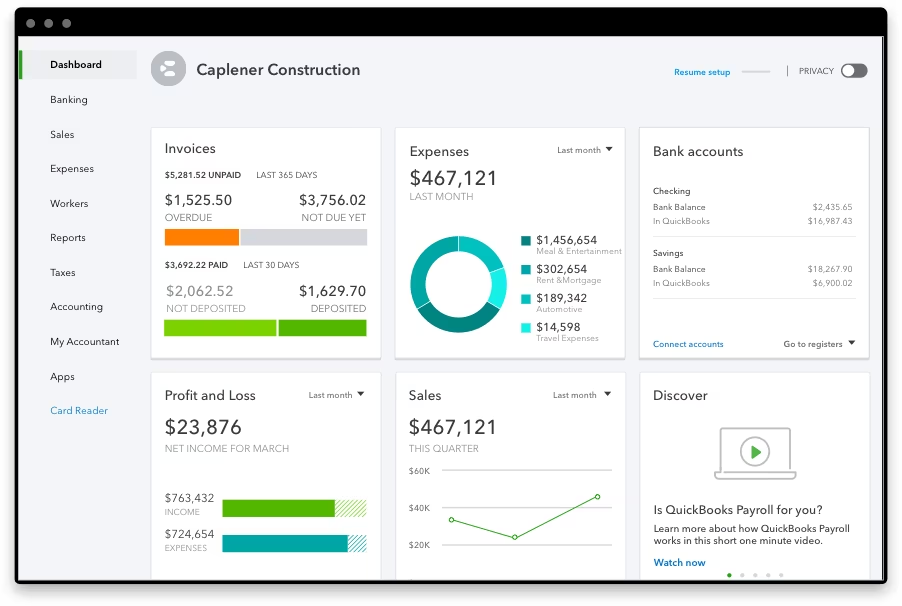

QuickBooks Online overview

QuickBooks Online is a popular choice for eCommerce accounting software businesses due to its comprehensive features, integration capabilities, and user-friendly interface. However, it’s essential to evaluate your specific business needs and budget to determine if it’s the right fit for you.

What we like

- Comprehensive accounting features: QuickBooks Online offers a wide range of accounting features, including invoicing, expense tracking, bank reconciliation, convert pdf bank statement, inventory management, and financial reporting. This makes it suitable for various types of ecommerce businesses.

- User-friendly interface: Users appreciate the user-friendly interface and intuitive design of QuickBooks Online. The dashboard provides a clear overview of the financial health of the business.

- Integration capabilities: QuickBooks Online integrates seamlessly with many popular ecommerce platforms, payment gateways, and third-party apps. This integration streamlines data flow and reduces the need for manual data entry.

- Mobile accessibility: The availability of a mobile app allows users to manage their finances on the go, which is especially useful for ecommerce entrepreneurs who are often on the move.

- Scalability: QuickBooks Online can accommodate the growth of ecommerce businesses, making it suitable for startups as well as established enterprises.

- Robust reporting: Users have access to various reporting options, including profit and loss statements, balance sheets, and customizable reports that can help track key ecommerce metrics.

- Tax support: QuickBooks Online assists with tax calculations, supports multiple tax jurisdictions, and helps users generate tax reports, which is crucial for ecommerce businesses dealing with complex tax situations.

- Data security: QuickBooks Online places a strong emphasis on data security, with features like data encryption and regular data backups.

- Customer support: The software offers customer support through phone, email, and a knowledge base, providing assistance to users when they encounter issues or have questions.

What’s Missing

- Cost: While QuickBooks Online offers a range of plans to fit different budgets, some users might find the pricing relatively higher compared to some competitors, especially if they need advanced features.

- Advanced inventory management: While it provides inventory management capabilities, businesses with complex inventory needs might require more advanced features that QuickBooks Online may not fully address.

- Learning curve: While QuickBooks Online is user-friendly, there can still be a learning curve for those new to accounting software, especially when dealing with more advanced features.

Plans & Pricing

QuickBooks Online offers several pricing tiers, including:

- Simple start: This plan is suitable for very small businesses and starts at an affordable monthly fee.

- Essentials: The Essentials plan offers additional features such as bill management and multiple users.

- Plus: The Plus plan includes features like project tracking and inventory management.

- Advanced: This is the most feature-rich plan, offering advanced reporting and dedicated support.

2. Xero: Best software for eCommerce businesses that require unlimited users

Xero Overview

Xero is a popular choice for ecommerce businesses, especially those that require unlimited users. It offers comprehensive accounting features, ease of use, and a vast integration ecosystem to help streamline business operations. Consider your specific needs and budget when evaluating if Xero is the right accounting software for your ecommerce business.

What we like

- Unlimited users: One of the standout features of Xero is its ability to accommodate unlimited users on all pricing plans, which can be particularly attractive for growing ecommerce businesses with multiple team members who need access to accounting data.

- Comprehensive accounting features: Xero offers a robust set of accounting features, including invoicing, expense tracking, bank reconciliation, inventory management, and financial reporting, making it suitable for various ecommerce business needs.

- Ease of use: Users often praise Xero for its user-friendly interface and straightforward navigation, which can help even those without accounting expertise manage their finances effectively.

- Integration ecosystem: Xero has a vast ecosystem of integrations and add-ons that allow you to connect it with popular ecommerce platforms, payment gateways, and other third-party apps to streamline your business operations.

- Bank feeds: Automatic bank feeds help keep financial data up to date by syncing with your bank accounts, reducing manual data entry.

- Customizable invoices: Xero offers customizable invoice templates, allowing businesses to create professional invoices tailored to their branding.

- Mobile accessibility: With a mobile app, users can manage their finances and access important data while on the go.

- Inventory management: Xero offers inventory tracking features to help ecommerce businesses monitor their stock levels, cost of goods sold, and profitability.

- Strong reporting: Users have access to a range of financial reports, including profit and loss statements, balance sheets, and cash flow reports, helping them gain insights into their business’s performance.

What’s Missing

- Learning curve: Although Xero is user-friendly, there may still be a learning curve, especially for users new to accounting software.

- Pricing: While Xero offers competitive pricing, some users may find the cost slightly higher compared to entry-level plans of other accounting software, especially if they require advanced features.

Plans & Pricing

- Starter: This plan is suitable for small businesses and offers basic accounting features.

- Standard: The Standard plan includes additional features like unlimited invoices, bills, and bank transactions.

- Premium: The Premium plan offers more advanced features like project tracking and expense claims.

3. Zoho Books: Best for eCommerce companies looking for integrated management software

Zoho Books Overview

Zoho Books is a solid choice for ecommerce businesses seeking integrated management software within the Zoho ecosystem. It offers comprehensive accounting features, affordability, and customization options. When considering Zoho Books, assess how well it aligns with your specific business needs and whether integration with other Zoho tools is beneficial for your operations.

What we like

- Integrated management: Zoho Books is part of the broader Zoho suite, which includes various business management tools. Users appreciate the ability to integrate Zoho Books with other Zoho applications like Zoho CRM and Zoho Inventory for a more comprehensive business management solution.

- Affordability: Zoho Books is often considered a cost-effective option, making it attractive to small and growing ecommerce businesses. It offers competitive pricing with various features even in its lower-tier plans.

- Comprehensive accounting features: Zoho Books provides core accounting functionality, including invoicing, expense tracking, bank reconciliation, inventory management, and reporting, making it suitable for ecommerce businesses.

- Automation: The software offers automation features like recurring invoices, payment reminders, and bank feeds to streamline financial processes and reduce manual work.

- Customization: Users can customize invoices and reports to align with their branding and business requirements.

- Mobile accessibility: Zoho Books offers a mobile app, allowing users to manage their finances on the go.

- Inventory management: Ecommerce companies can benefit from Zoho Books’ inventory management features, which help track stock levels and costs.

- Reporting: The software offers various reporting options to help businesses gain insights into their financial performance.

Read more: Magento 2 inventory reports: Why you need it in 2023?

What’s Missing

- Scalability: While Zoho Books is suitable for small to medium-sized businesses, larger ecommerce enterprises with complex accounting needs may find it less scalable than some other solutions.

- Learning curve: Like other accounting software, there can be a learning curve for users new to the platform, especially if they are integrating it with other Zoho applications.

Plans & Pricing

- Basic: This plan is suitable for small businesses and includes essential accounting features.

- Standard: The Standard plan offers additional features like recurring invoices and inventory tracking.

- Professional: The Professional plan includes advanced features such as purchase orders and budgeting.

4. Wave: Best free software for companies willing to use zapier for eCommerce integrations

Wave Overview

Wave is a popular choice for small ecommerce businesses that prioritize cost-effectiveness. Its free accounting software, user-friendly interface, and features like invoicing and expense tracking can meet the basic financial management needs of many small businesses. However, it may not offer the advanced functionality or extensive integrations found in paid accounting software, so businesses with more complex requirements should carefully evaluate whether Wave is a suitable fit.

What we like

- Free accounting software: One of the standout features of Wave is that it offers free accounting software, making it an attractive choice for small ecommerce businesses with budget constraints.

- Invoicing: Users can create and send professional invoices for free using Wave, which is beneficial for businesses looking to manage their finances without incurring additional costs.

- Expense tracking: Wave allows users to track expenses, categorize them, and generate reports, helping businesses monitor their spending.

- Bank reconciliation: Users can connect their bank accounts to Wave, which streamlines bank reconciliation and reduces the need for manual data entry.

- User-friendly interface: Wave is known for its intuitive and user-friendly interface, making it accessible to users with varying levels of accounting knowledge.

- Unlimited users: Wave allows unlimited users to collaborate on the platform, which can be advantageous for small businesses with multiple team members.

What’s Missing

- Limited features: While Wave offers essential accounting functionality, it may lack some of the advanced features and integrations found in paid accounting software. This can be a limitation for businesses with complex needs.

- Integration limitations: While Wave offers integrations through Zapier, it may not have native integrations with as many ecommerce platforms and apps as some other paid accounting software options.

- Support: Wave’s customer support options are somewhat limited compared to paid solutions. Users may not have access to phone support or extensive online resources.

Plans & Pricing

- Wave’s accounting software is free to use, making it an attractive option for businesses looking to manage their finances without incurring software costs.

- However, Wave also offers additional paid services, such as payment processing and payroll. The pricing for these services varies depending on the specific service and your location. For example, payment processing fees are associated with credit card processing transactions, and payroll services have a base fee plus a fee per employee paid.

- It’s essential to review Wave’s pricing details on their website to understand the costs associated with any additional services you may need.

The Bottom Line

In conclusion, the realm of e-commerce is marked by constant innovation and change, and 2023 is no exception. The importance of selecting the right accounting software cannot be overstated, as it directly impacts the financial health and growth of online businesses. As we embark on the journey through 2023, making the right choice in accounting software is not just a smart business decision; it’s a strategic move that can empower your e-commerce venture to thrive and flourish. By leveraging the insights provided in this guide, you can position your business for financial success in the dynamic world of e-commerce, ensuring a prosperous and profitable year ahead and beyond.