How to Integrate Sage Pay with Magento 2?

For online shoppers, the things they truly concern when making payment online is no doubt the security of their card information. Understanding the importance of protecting customers’ private data, especially payment data, Sage Pay is born to handle the customer and online business worry. In this blog, users can have some basic views about Magento 2 SagePay extension gateway as well as be guided simply to integrate Sage Pay Extension for your Magento 2 websites.

About Sage Pay

As one of the top payment gateways, Sage Pay is a well-known and used Payment Service platform in Europe. Processing card transactions and other forms of payment securely are Sage Pay’s mission, as well as helping to prevent fraud and security breaches.

Sage Pay has been developed by The Sage Group, an accounting software company. The figures of this software speak of its success: 4 billion payments processed in 12 months, for tens of thousands of European companies, employing 300 employees.

The operation of Sage Pay uses a server integration method between merchants and customers: when a payment is processed, a transaction log is sent to Sage Pay systems, which redirect customers for recognition. When the platform has verified that the details are correct, it authorizes the merchant and the appropriate card-provider.

After receiving a response to this authorization, Sage Pay indicates the status of the transaction, which can be one of the followings:

- Accepted

- Rejected

- Invalid

This is followed by other checks, aimed at preventing fraudulent transactions and security breaches before the payment is completed. The most surprising thing is that Sage Pay performs these procedures quickly, shortening to the maximum the waiting times that stop the cash flow of companies.

Instruction to Integrate Sage Pay with Magento 2 stores

Sign Up Sage Pay Account

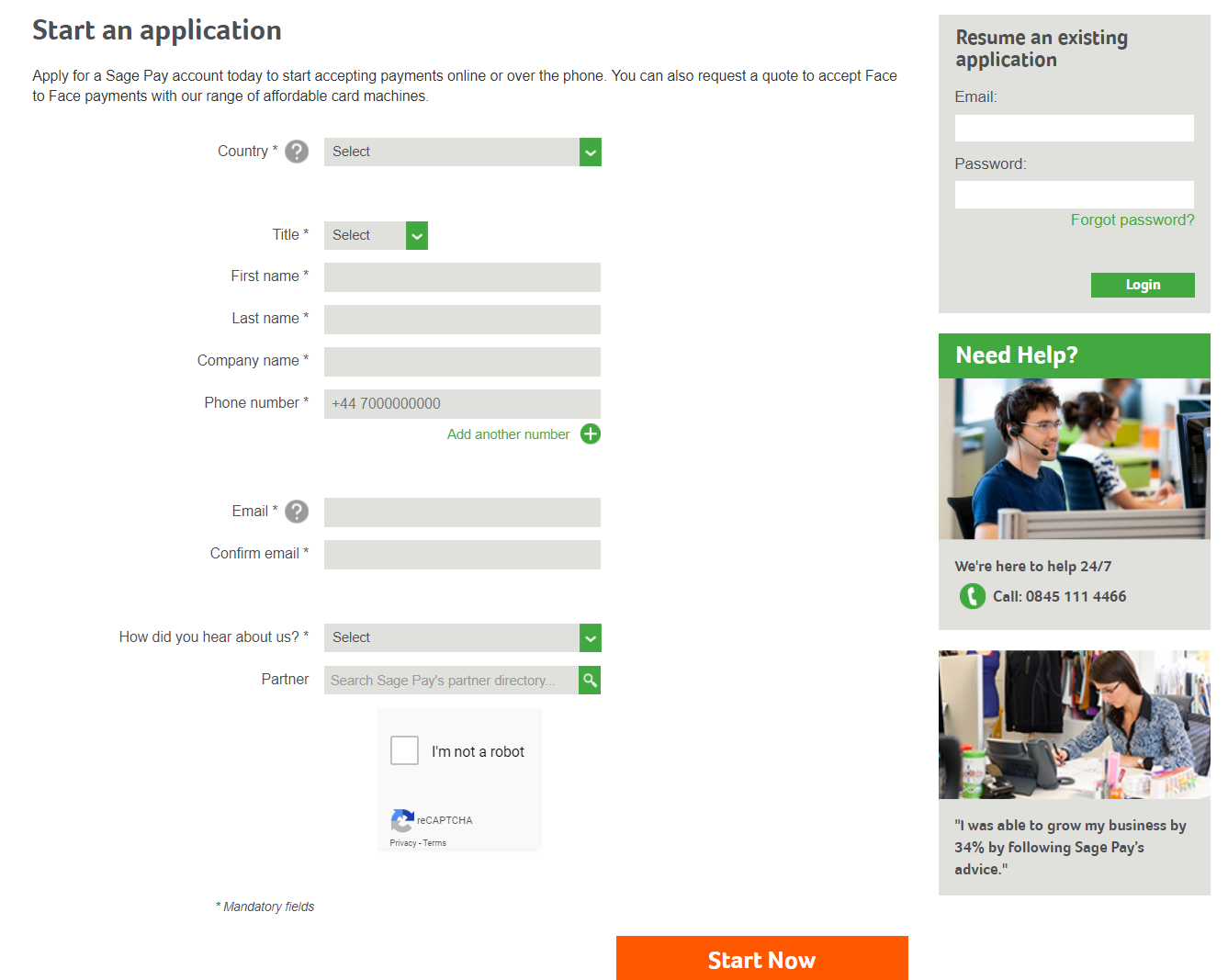

Before connecting your checkout process with Sape Pay, you need an account there. You can register a new account via official website of Sage Pay.

Note: After registering an account, Sage Pay will send mail for authentication and after completing the registration, Sage Pay will send information of Vendor Name, Username, Password. You need to save the above information to connect with Sage Pay.

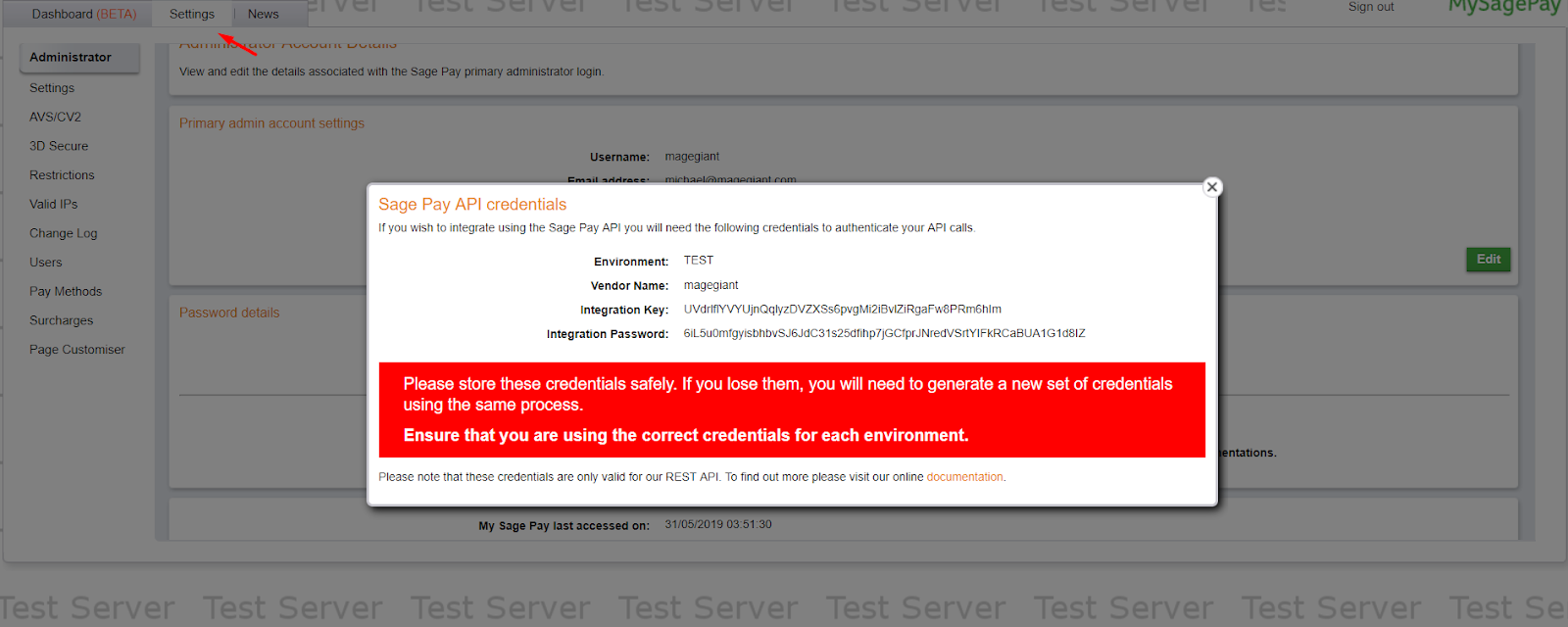

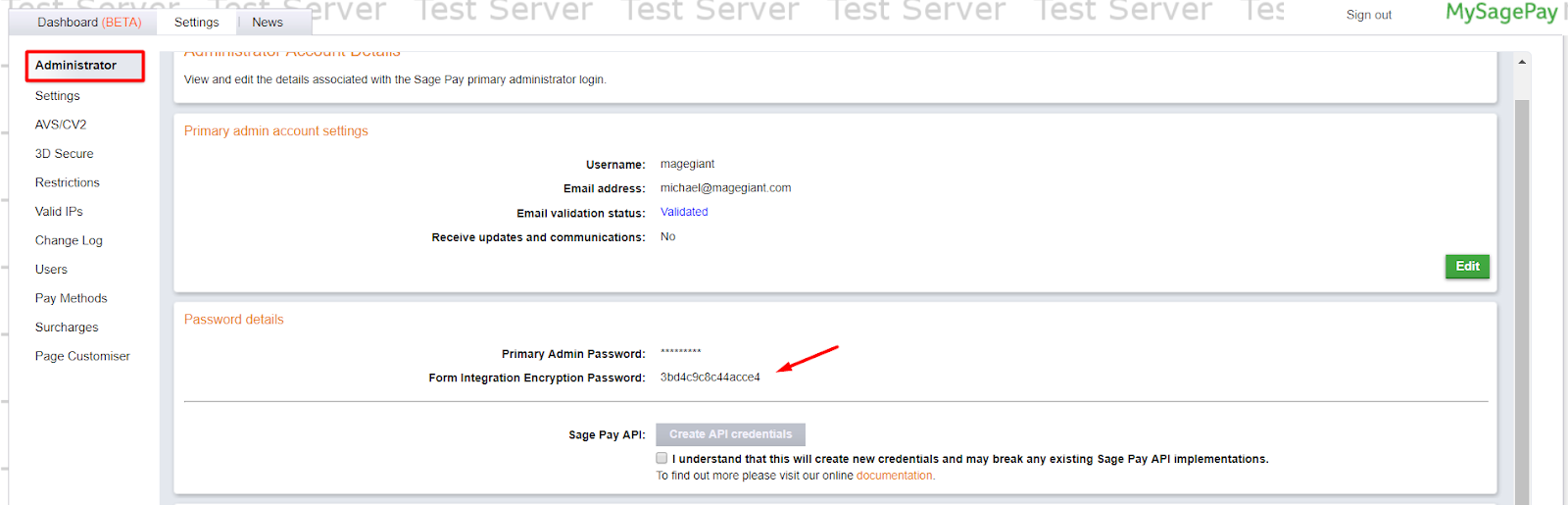

Access to Sage Pay, sign in by the account you registered before. Then go to Settings > Administrator, stick to I understand that this will create new credentials and may break any existing Sage Pay API implementations. then click Create API credentials button to get the Integration Key, Integration Password. Here, you also can get the information of Form Integration Encryption Password.

Configure to Integrate Sage Pay module

In this post, you are being introduced to Mageplaza Sage Pay extension. Let’s download Sage Pay and install the module before you learn how to configure it properly onto your store checkout page. Visit this link for more details instructions.

Get Seamless Magento Integration Today!

Exclusive Features of Sage Pay Integration

Support 3 interface options

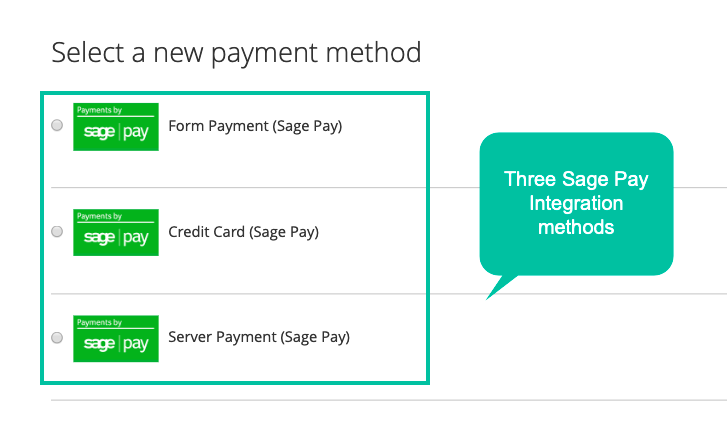

An interesting function of Sage Pay is that store runners can choose how Sage Pay can be used by customers at their checkout page. There are three options supported: Sage Pay Direct, Sage Pay Server and Sage Pay Form.

With Sage Pay Direct, customers can leave their card info totally on checkout. The credit card filling form is well fitted to the checkout page. Magento stores will have more control on customers payment information with this integration method.

Also allowing store owners to have more control on payment transactions, Sage Pay Server is only different from Direct method is that it enable customers to leave their card information via an embedded form. This feature also called Iframe interface. No redirect to the separated site will help process the checkout faster.

Sage Pay Form works as a hybrid method of the two above. It supports a simple encrypted form submission in the store checkout sending to Sage Pay site. Customers then are moved to Sage Pay hosted page and are required to provide all the information there.

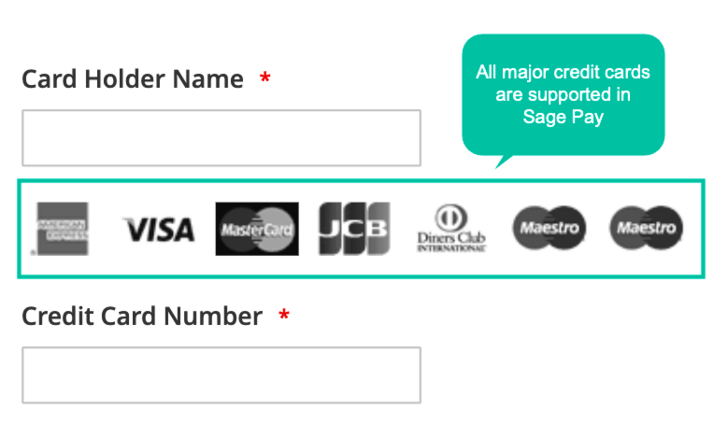

Allow Almost Worldwide Cart Types

Support all commonly used credit cards and debit cards in the world, Sage Pay is so convenient for customers shopping online. They can check out quickly and accurately by Visa, Mastercard, Maestro International, Maestro Domestic, American Express, JCB, Diners Club, and Laser.

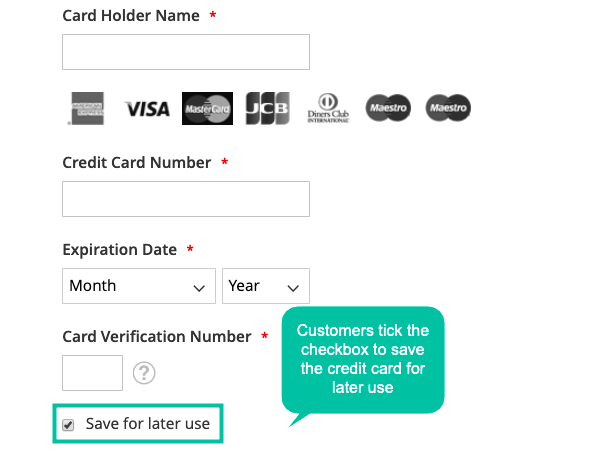

Save Credit Card for Next Purchase

In Sage Pay, a useful feature supported is Credit Card Vault which helps save card information at the first check out. All those card information will be recorded and shown at Customer Dashboard at their My Account page.

Customers then do not have to fill in their credit card data when they continue to buy at your stores the next times. It will save a lot of time at checkout page, boost your conversion rate and reduces cart abandonment. Everyone loves the convenient and quick process of online shopping including payment procedure.

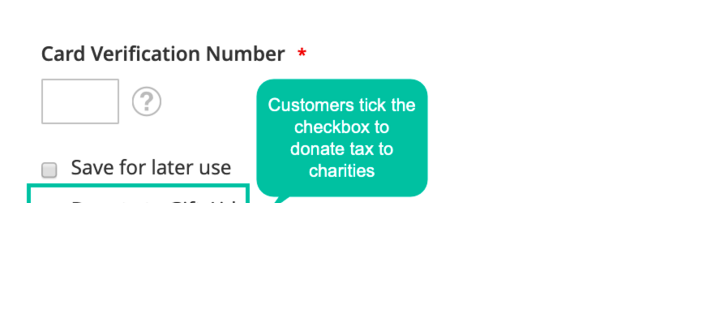

Allow Donating to Charity via Gift Aid

One interesting feature of Sage Pay is that it integrates with charity organizations to allow customers to donate their tax fee there. This meaningful feature will give customers the right to do charity with government protected organizations without going anywhere and connecting to anyone. A Gift Aid checkbox is shown at the checkout page with Iframe Interface and shown at Sage Pay Page if stores use Direct and Form options.

Provide High-Security Methods

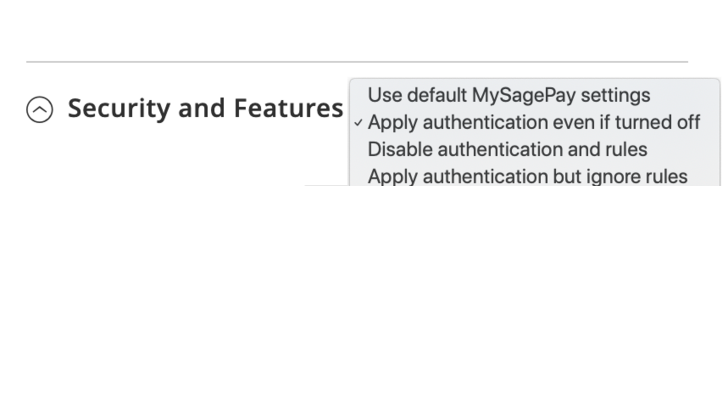

As mentioned at the beginning of the post, the threat of fraud and information theft forced e-stores to use the most trusted and highest security guarantee for their checkout process. With Sage Pay, your customers can be assured to give out their card information at your site. There are three security layers combined within the payment: AVS/CV2 and 3D Secure.

While AVS/CV2 verify customers’ card authenticity by its address and final digits at the back of their cards, 3D Secure requires a PIN number filling which is sent to customers mobile devices before.

Integrate Sage Pay at Backend

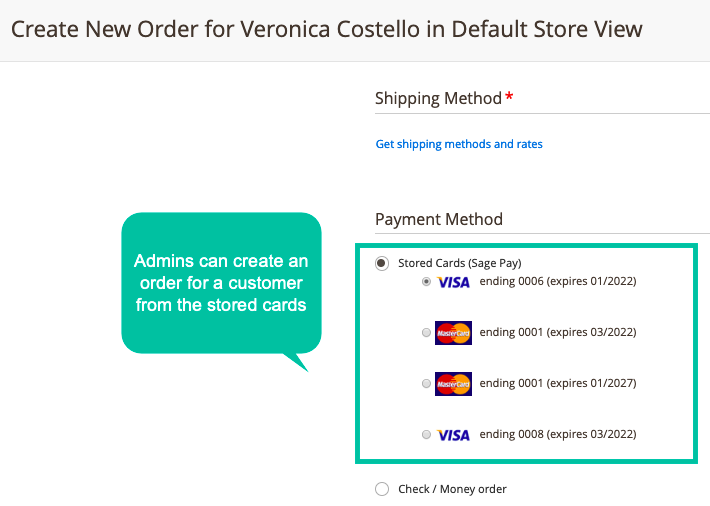

Not only customers can use Sape Pay to process purchase at frontend. Admins also have the ability to create order then conduct payment via Sage Pay at Back-system. This function is beneficial for both customers and stores themselves when they need to make an order instead of their customers. With the saved information of customers at the first purchase, admin can definitely ask for the right to reuse it from the second order to process the payment for clients. Your customers do not have to spend any time more but still get the wanted items.

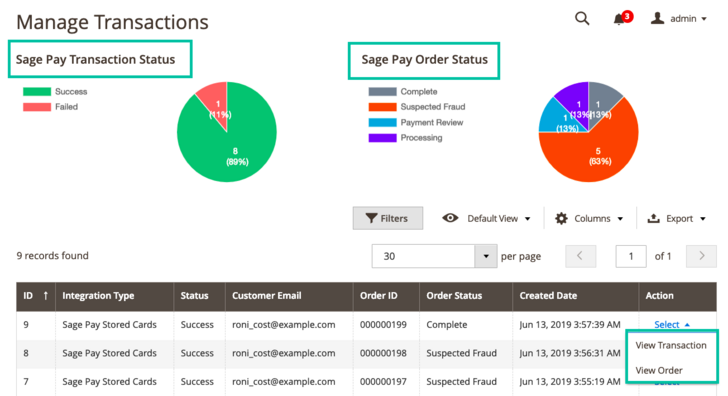

Flexibly Manage Sage Pay Transactions and Orders

Supporting Transaction Status Chart, store runners can have a close look at which payment transactions are failed and which one succeeds. Also, Sage Pay provides an Order Status Report in Chart form, which show the proportion of order status including canceled, close, complete, on hold, suspected fraud and so on. Website owners always can grasp their order status and make improvement for them.

For viewing the more details of Sage Pay Transactions and order Status, Magento 2 Report extension is highly compatible with this module. Admins can view the Reports and filter for different time durations right on the Admin Dashboard.

Full features provided by Sage Pay Extension

For Store Admins

General Setting

- Sage Pay registered account can be filled in

- Choose environment to apply to the site including Sandbox for testing and Production

- Integrate Sage Pay Form method by inputting encryption password

- Integration key and password are inputted to use for integration of Sagepay PI/Direct.

- Turn on/ off 3D Secure when authenticating customers’ cards

- Turn on/ off AVS/ CV2 when verifying customers’ cards

- Approve/ Disapprove store admins to use Sage Pay to create new orders through customers’ saved credit cards.

- Show the logo of Sage Pay on the Checkout Page

- Allow/ Disallow Gift Aid to donate tax for charities

- Choose a language for the Sage Pay payment page

- A notice can be added on the Checkout Page about surcharge fee.

Sage Pay Direct/PI Integration

- Sage Pay Direct/PI Integration method is allowed

- The title for the payment could be set

- Allow setting status which can be approved or rejected by admin (processing or suspected fraud) after customers make payment successfully

- Payment action (authorize and capture, or authorize) can be set

- Choose one or multiple card types which applies to Sage Pay

- Choose display checkout: with Magento default theme or Drop-in (pop-up or inline)

- Allow/ Disallow Customer Credit Vault to save cards of customers for future use

- Set the title of Vault at Checkout Page

- Choose nations to apply this method

- Determine this payment method’s display position compared to other methods

Sage Pay Form Integration

- Allow the Sage Pay Form Integration method

- Set the payment’s title

- Allow setting status which can be approved or rejected by admin (processing or suspected fraud) after customers make payment successfully

- Payment action (authorize and capture, or authorize) can be set

- Choose nations to apply this method

- Enable/ Disable confirmation email to be sent to admins only, or both admins and customers

- Determine the display position of Sage Pay Form Integration compared to other methods

Sage Pay Server Integration

- Allow the Sage Pay Server Integration method

- Set the payment’s title

- Allow setting status which can be approved or rejected by admin (processing or suspected fraud) after customers make payment successfully

- Payment action (authorize and capture, or authorize) can be set

- Choose display profile: Low or Normal

- Choose nations to apply this method

- Determine the display position of Sage Pay Server Integration compared to other methods

Manage Transaction

- Allows recording card details of customers or admins paid through Sage Pay

- Admins are redirected to the view order page to view the information and card information.

- Sage Pay Transaction Status chart allows seeing Sage Pay transaction status (success or failed)

- Sage Pay Order Status chart allows viewing all orders’ status paid by Sage Pay

Refund Order

- Enable refund Online / Offline for the partial or whole order

Extra Fee

- The surcharge amount is added for each card

For Customers

- Having another way to make a payment, which is highly secure and fraud prevention

- All major card types can be used with Sage Pay

- Credit cards information is saved for further use

- Allow making payment fastly and conveniently

- Experience a superior shopping

Final Words

Choosing to integrate which payment gateway to your online business is super importance to gain customers’ trust and reliance. Among various payment extension, SagePay for Magento 2 is the undeniable great choice for you. By integrating Sage Pay gateway to e-commerce stores, it helps process customers’ payment much faster and convenient. Sage Pay accepts all major credit cards and debit cards as well as allows saving Sage Pay cards securely with token systems.