Hyvä Theme is Now Open Source: What This Means for Magento Community - Mageplaza

Hyvä is now Open Source and free. Discover what changed, what remains commercial, how it impacts the Magento ecosystem, and how to maximize its full potential.

You are wondering which to choose among various payment providers for your Magento stores? Your biggest concerns and priorities are safety and simple integration process for your e-commerce websites. You might want to listen about SecurePay - a famous payment gateway from Australia. In this blog, we are going to bring you the highlight information of this payment method as well as its integration tool for M2 store. Eventually we want to help you make the best decision on building and improving your checkout process.

Being an online payment expert originated from Australia, SecurePay offers e-commerce payment solutions for online organizations and businesses in all scopes and sizes. It offers a large number of online payment methods, including SecurePay, a highly trusted and long-life used method that can commonly get organizations selling on the web in five business days.

Known as a pioneer in the online payments industry in the Australian market, SecurePay has extensive experience working with Australian organizations. For over 15 years of operation, it has helped over 40,000 online organizations jump on track with their web based business needs, particularly the small and medium-size organizations.

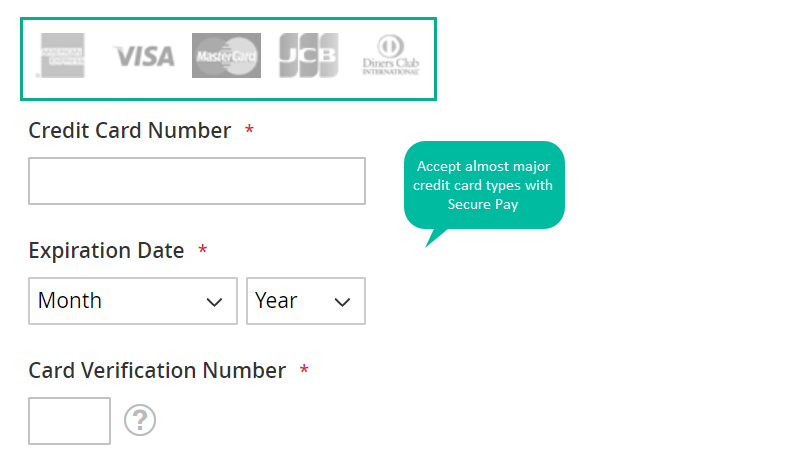

One of the most beneficial features of this payment gateway is that it allows online shoppers to have more payment options, for example, Visa, MasterCard, American Express, Diners Club International, and PayPal. It also enables them to make an online order straight away, which can enable organizations to convert over more deals. In other words, SecurePay offers a straightforward online application process without any visits to banks required.

In term of business side, SecurePay is prefered since it offers a purely simple integrating process as it coordinates with many major internet shopping carts. Clients are likewise given access to real Australian banks for simple administration of payment. Moreover, SecurePay ensures secure online payments that guarantee to secure any transaction and client information from fraud or unauthorized access occurs.

With SecurePay, users can access their card information handily at any time. It also supports a very detailed reports of all occurred transaction of certain customers. Hence, store owners is assisted with better transaction management and formulate effective marketing strategies.

Firstly, we will guide you to create a SecurePay account:

If your registration is completed, SecurePay website will show a thank you popup which reminds you to check register email for confirmation.

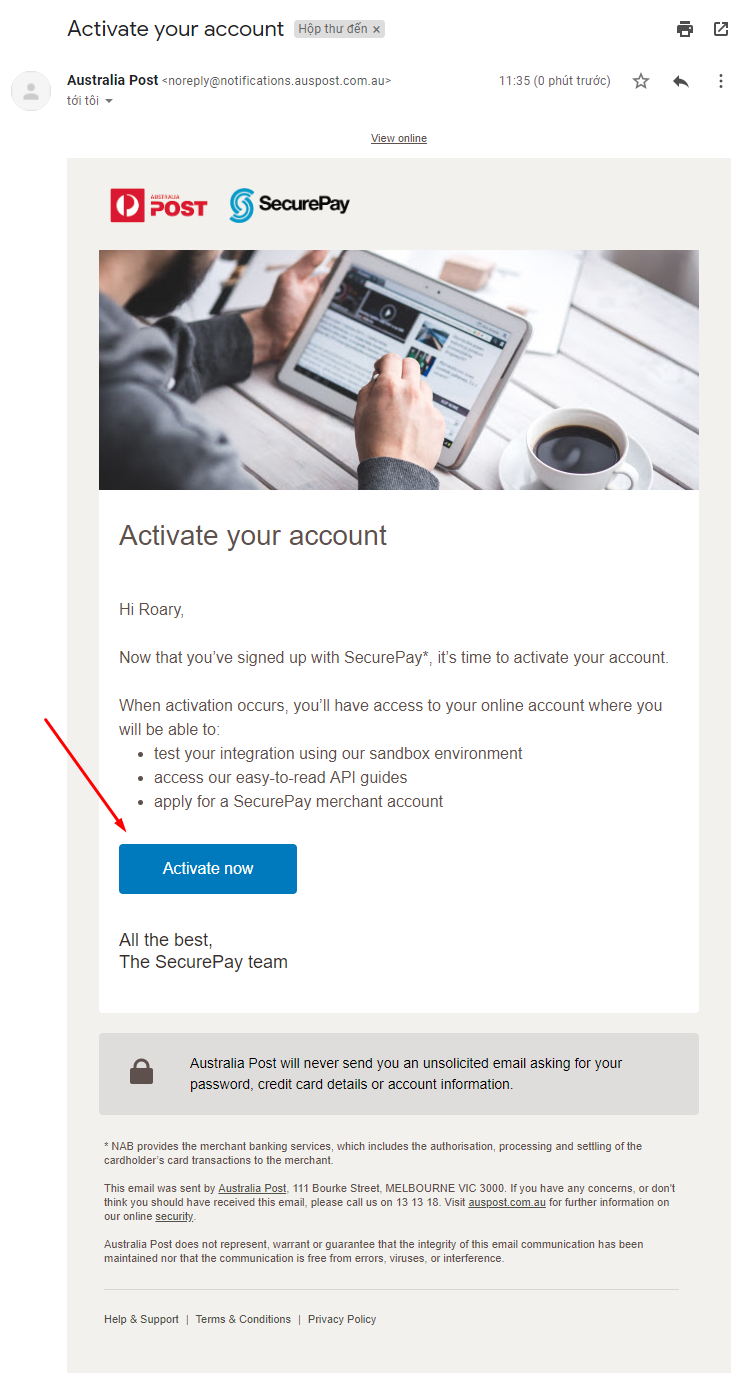

Open your registered mail, check the latest news from SecurePay, click Activate Now:

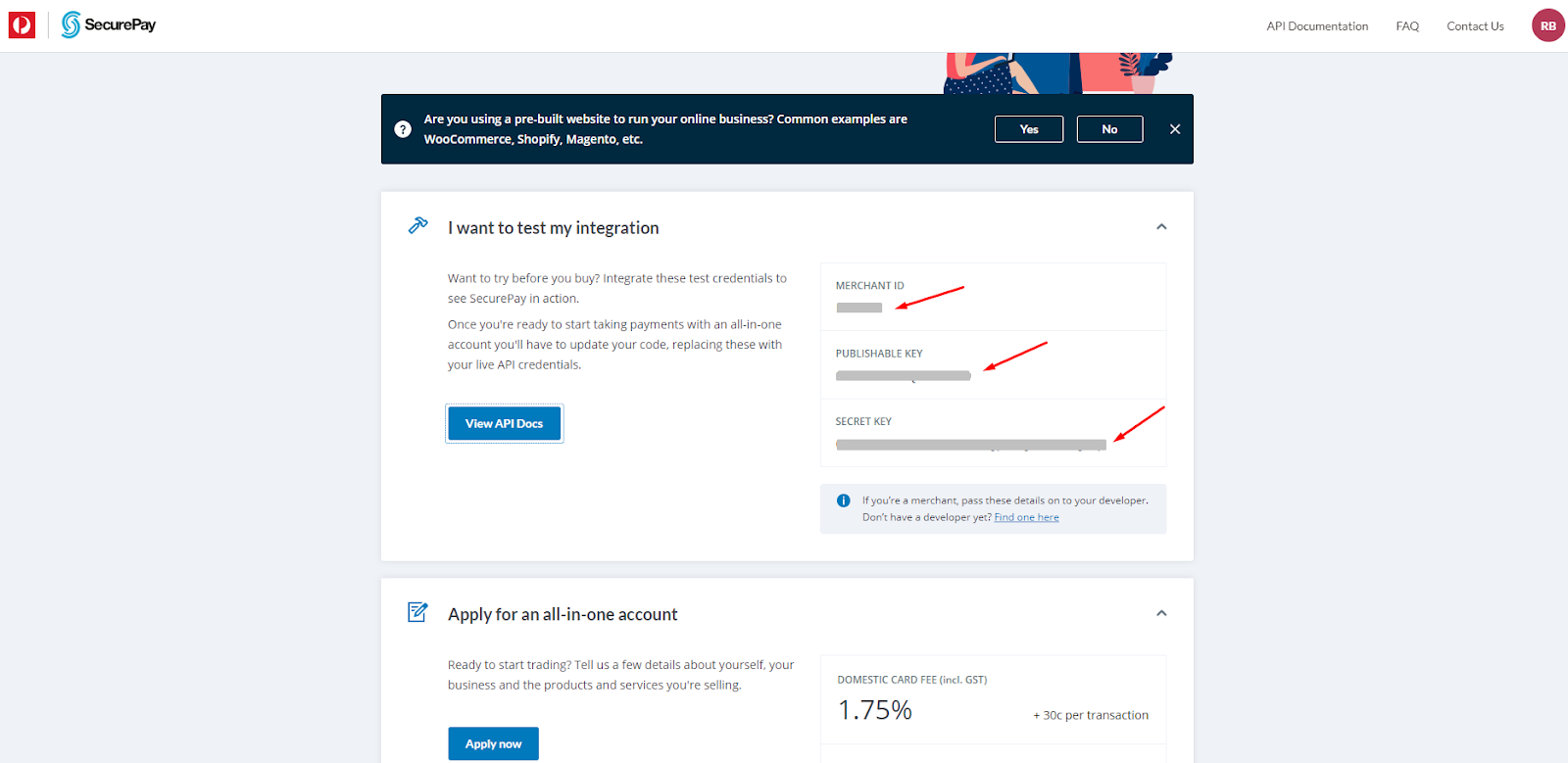

On the Securepay account page, you need to get the information including Merchant ID, Publishable Key, Private Key to fill in Configuration (will be guided below):

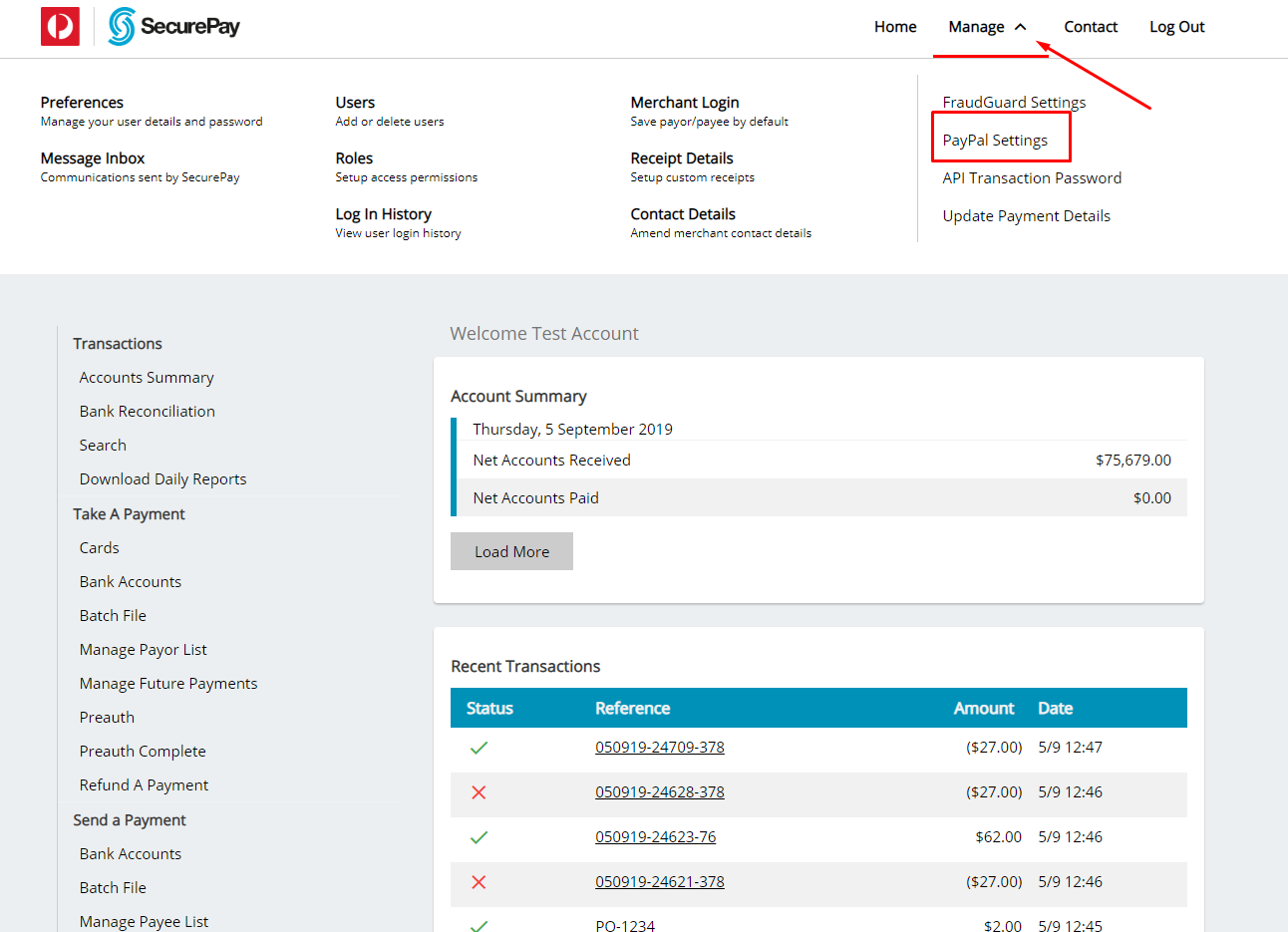

Click Manage > Paypal Settings to get Merchant Account ID and Transaction Password:

https://test.login.securepay.com.au/v3/Please see this user guide for more details of configuration.

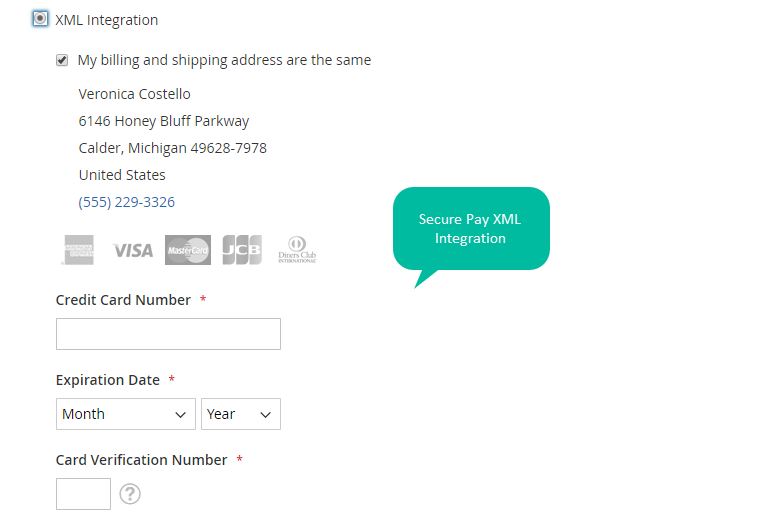

If you need a workable method for transmitting transaction details to SecurePay for processing, the Secure Pay XML API is the one for you. With this module, one operation will be contained in each XML message which is sent to SecurePay. This covers the program building process within your website or application to integrate the XML API, and it can run well on any platform as well as any programming language.

For processing, and XML message will be sent to an HTTPS URL at SecurePay through the POST method. One the process is done, a message will be sent back to your server also via the POST Method. It would normally take a few seconds for a message to be processed.

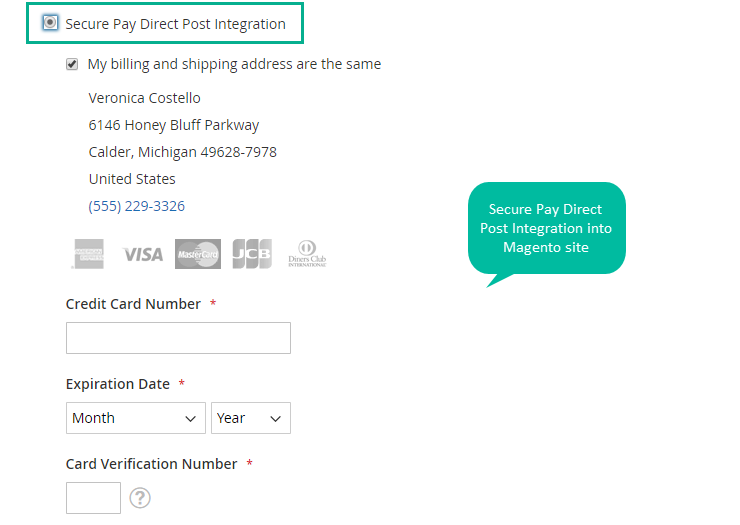

With the Direct Post feature, the transaction information will be transmitted directly from the customer’s card information to the SecurePay by allowing them to post their card information on a form that is displayed on your website.

This integration would make customers feel like they are using the Magento Default because of a similar interface. Unlike an API which transmitted the data directly from customers’ computer to Secure Pay and transactions will be completed there. With Direct Post, customers will be redirected back to the checkout page of your site to complete their orders.

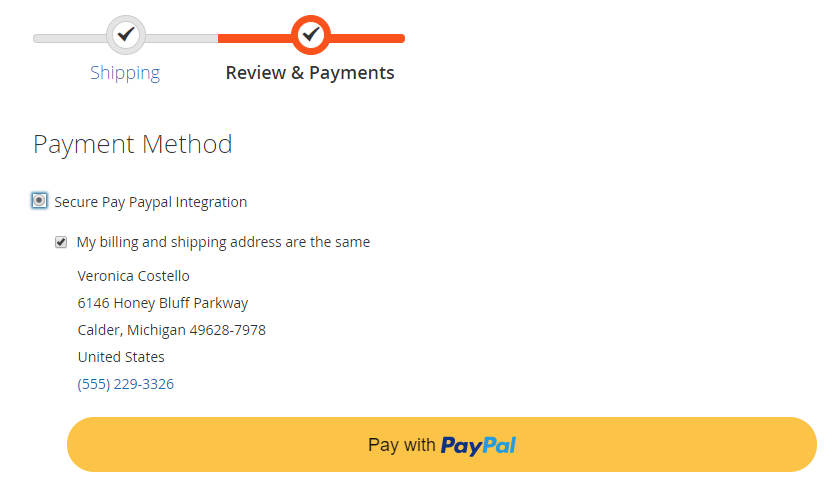

With this Secure Pay Paypal, the transaction gateway will be Paypal while Secure Pay will still be the place where the customers’ data will be stored.

This is a great combination as it offers customers, especially for whom are keen on paying using Paypal to make payment easily and conveniently.

This is one of the most noticeable functions of Secure Pay. All types of debit and credit cards which are popular globally will be accepted, including:

The diversity in card types will surely support both store owners and customers to process the payment smoothly and conveniently. This is because, according to research, the customers’ interest’ payment card will strongly affect the conversion rate. In other words, if the customers can pay using their own cart, the sales, as well as the conversion rate, will increase significantly.

Payment Card Industry Data Security Standard (or PCI DSS) is required for all stores that accept credit and debit card payments to ensure the security for customer’s data. Once you installed the Secure Pay module, your site will automatically comply with this standard.

In addition, the Secure Pay extension also has the ISO27001 certificate, which is a global information security management standard. This means that you can continue to grow your business and make customers trust you without worrying about these hassles of compliances.

It comes to the end of our article. Mageplaza hope that you can have a better understanding of SecurePay gateway. Especially, with SecurePay module, your stores’ customers are assisted to make payment easily via different cards including Visa, MasterCard, American Express, Diners Club, JCB.