How to Set Up Shopify Payments to Enhance Store Performance

Thanks to Shopify Payments, it’s now super easy to accept online payments. With this tool, customers don’t have to go through the hassle of setting up another payment service or sharing their info separately with Shopify. It’s all streamlined. Shopify Payments simplifies running your business by integrating a bunch of financial functions right into your online store.

To let customers pay with credit cards, you just need to set up and turn on Shopify Payments. You can do this in your Shopify settings under Payment providers.

This article will walk you through the steps to set up Shopify Payments, making the process crystal clear.

What is Shopify Payments?

The Shopify Payments gateway makes online payments hassle-free for both merchants and customers.

Now, brands don’t need to deal with the hassle of setting up third-party payment providers or extra accounts. It’s all taken care of.

Shopify Payments is already built into your Shopify account, so all you have to do is turn it on and configure it. Once it’s active, your Shopify Analytics will start using your Shopify Payments data for financial reports.

With Shopify Payments, you’re automatically equipped to accept credit cards and other major payment methods as soon as your Shopify store is up and running.

Shopify Development Services

Start generating more revenue with your enhanced Shopify store built by us. No more stress over platform complexity.

Learn moreBenefits of Using Shopify Payments

Here’s a simplified overview of the benefits of Shopify Payments:

Fast Payments

With Shopify Payments, you get your money quickly. The transfer time depends on when the customer pays and when the payment is sent to you. Some factors that affect this include:

- Shopify Balance account: Get your money in as little as one business day.

- Shop Pay Installments: Payments can take up to three business days.

- Weekdays or holidays: Most banks only process transfers on business days.

- Transfers on business days: You’ll usually get your funds the next day.

Shopify Payments is faster than some other processors like PayPal and Google Pay, which can take 3-5 days, and similar to Apple Pay, which takes 1-3 days.

Quick Setup

Shopify Payments is built into Shopify, so you can start using it right away without needing to install anything. This means you can start accepting orders faster.

Unify Online and Offline Sales

Shopify Payments works both online and in physical stores with Shopify POS. This lets you accept payments at pop-up shops, permanent stores, and more, creating a smooth experience from online browsing to in-store purchases.

Reduced Cart Abandonment

Shopify Payments supports many payment methods, which helps reduce cart abandonment by offering customers their preferred payment options.

Integrated Reports

Shopify Payments integrates seamlessly with Shopify’s reporting tools, making it easier to analyze all your sales data in one place.

Which is the Best Payment Provider for Shopify?

When a customer orders from your store, their payment needs to be processed before you receive it. A payment provider handles this, causing a delay before the money is credited to your bank account. Because of this, it’s important to carefully choose your payment methods on Shopify.

Third-party payment providers each have their own processes for collecting funds from customers. It’s a good idea to list the providers that suit your needs and check their websites for more details.

Most payment providers charge a fee for processing transactions. However, Shopify Payments only charges fees for credit card transactions. If your Shopify store is in one of the supported countries, you can use Shopify Payments. If not, don’t worry—Shopify offers many third-party payment options, consider the following examples:

Stripe

Stripe is a payment gateway that makes it easy for businesses and freelancers to accept payments online. They also offer a retail terminal for accepting in-person payments.

Processing Fees

- Stripe’s fees vary by country. In the USA, the fees are:

- Cards: 2.9% plus 30¢ per transaction

- ACH direct debit: 0.8% with a $5 maximum fee

- iDEAL: Starts at 80¢ per transaction

Accepted Payment Methods

Stripe supports various online wallets and major credit cards, including:

- Online Wallets: AliPay, iDEAL, SEPA Debit, Klarna

- Credit Cards: Visa, MasterCard, American Express, Discover, UnionPay, JCB

PayPal

PayPal is another popular payment gateway for accepting online payments.

Processing Fees

PayPal charges different fees depending on the payment method:

- Alternative Payment Methods (APMs): 2.59% + fixed fee

- PayPal Checkout: 3.49% + fixed fee

- Send/Receive Money for Goods and Services: 2.99%

- Standard Credit and Debit Card Payments: 2.99% + fixed fee

Additionally, PayPal charges a fixed fee based on the currency received and an extra 1.5% for international transactions.

Accepted Payment Methods

PayPal supports various payment methods, including:

- Credit Cards: MasterCard, Visa, Discover

- Digital Wallets: Venmo, PayPal balance

Apple Pay

Apple Pay is a digital wallet service that lets customers make payments using their Apple devices. It also offers a secure way to pay online through Apple Pay on the Web.

Processing Fees Apple Pay does not charge any extra processing fees.

Accepted Payment Methods

Apple Pay supports credit and debit cards from many leading financial institutions and major payment networks worldwide. You can view the full list here.

Amazon Pay

Amazon Pay allows customers to use their Amazon account to make purchases on Shopify stores. You might have seen Amazon buy buttons—this is the technology behind them.

Processing Fees

Amazon Pay charges transaction-based fees, including:

- Domestic Processing Fee: 2.9% for web and mobile, 4% for Alexa

- Cross-Border Processing Fee: 3.9% for web and mobile, 5% for Alexa

- Authorization Fee: $0.30 per transaction

- Chargeback Fee: $20.00 plus applicable tax

Accepted Payment Methods

Amazon Pay supports various credit and debit cards, including:

- Visa

- Mastercard

- Discover

- American Express

- Diners Club

- JCB

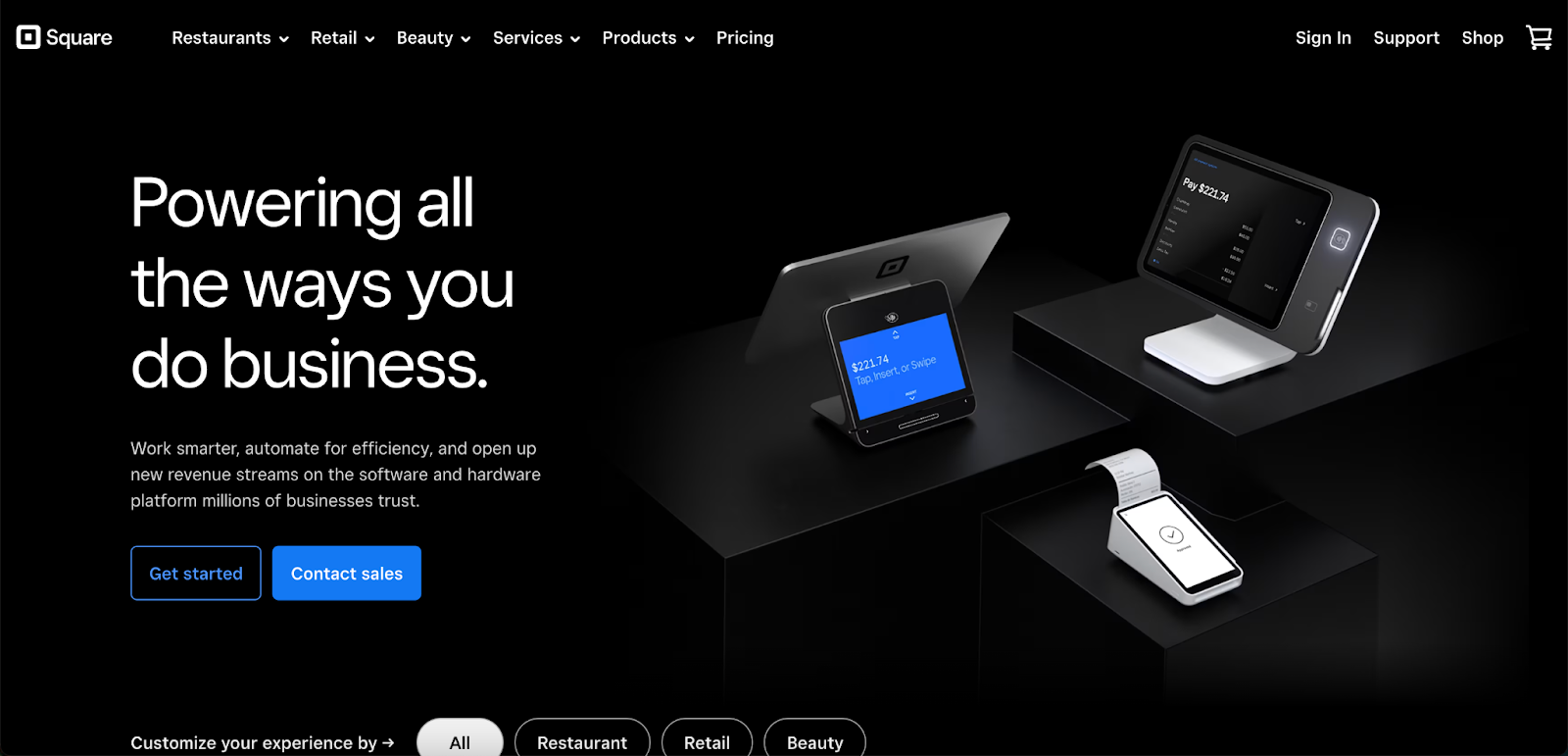

Square

Square Payments gained popularity for its portable card reader, enabling merchants to transform their smartphones into POS systems with Square’s distinctive square device.

This payment gateway seamlessly integrates online and retail selling, offering convenient payment options for consumers both on e-commerce websites and in-person.

Processing Fees

Square charges:

- For their free and plus plans: 2.9% plus 30¢ per online transaction.

- For their premium plans: 2.6% plus 30¢ per transaction.

Accepted Payment Methods

Square supports various payment methods, including:

- Online wallets like Apple Pay and Cash App

- Credit cards: Visa, Mastercard, Discover, American Express

You can see all of Square’s supported payment methods here.

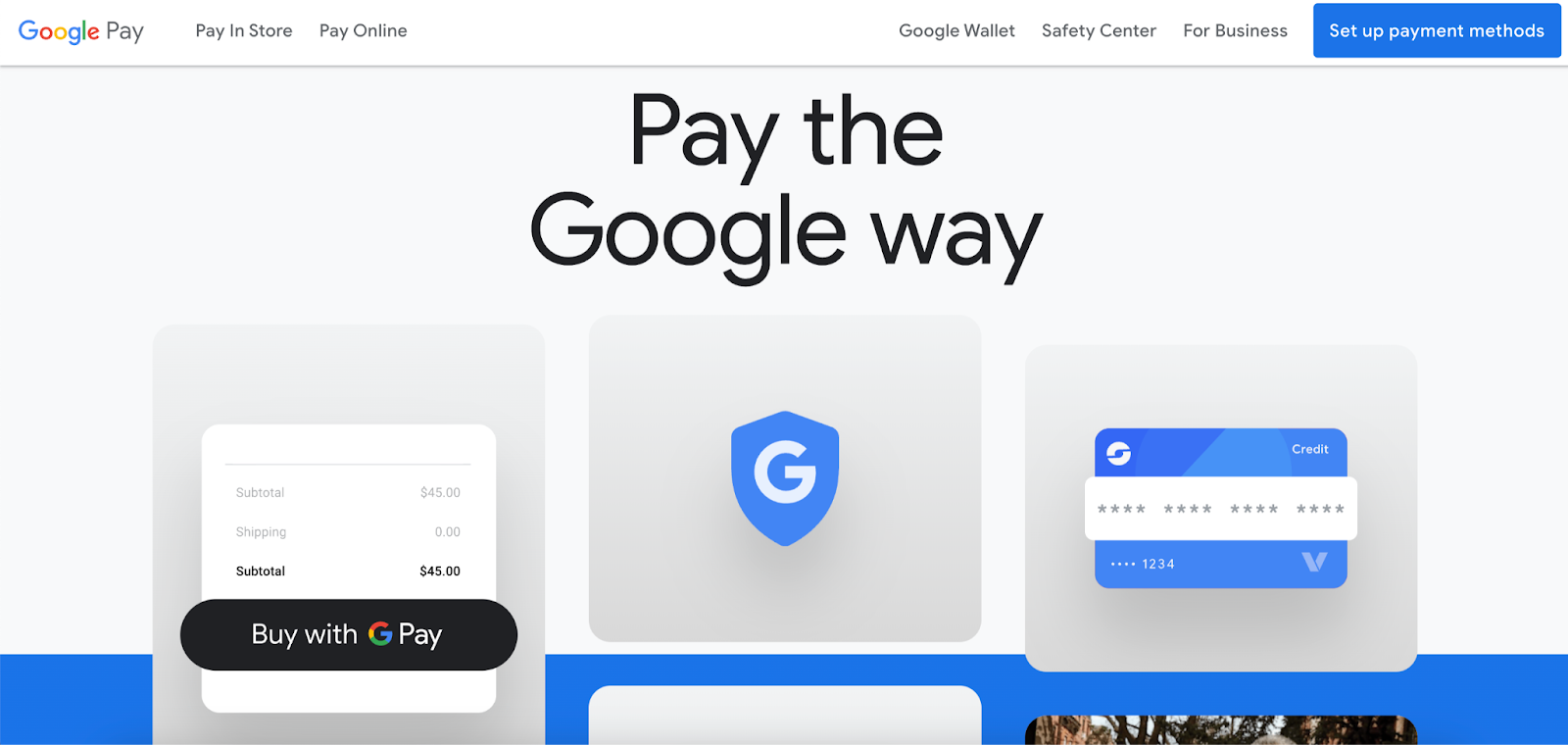

Google Pay

Google Pay is a digital wallet service that allows customers to make payments using their Android devices.

Processing Fees

Google Pay charges transaction-based fees, which can range from 1.5% to 4%. For debit card transactions, there’s a charge of $0.31 or 1.5%, whichever is greater.

Accepted Payment Methods

Google Pay supports major credit and debit cards, including:

- American Express

- Discover

- JCB

- Mastercard

- Visa

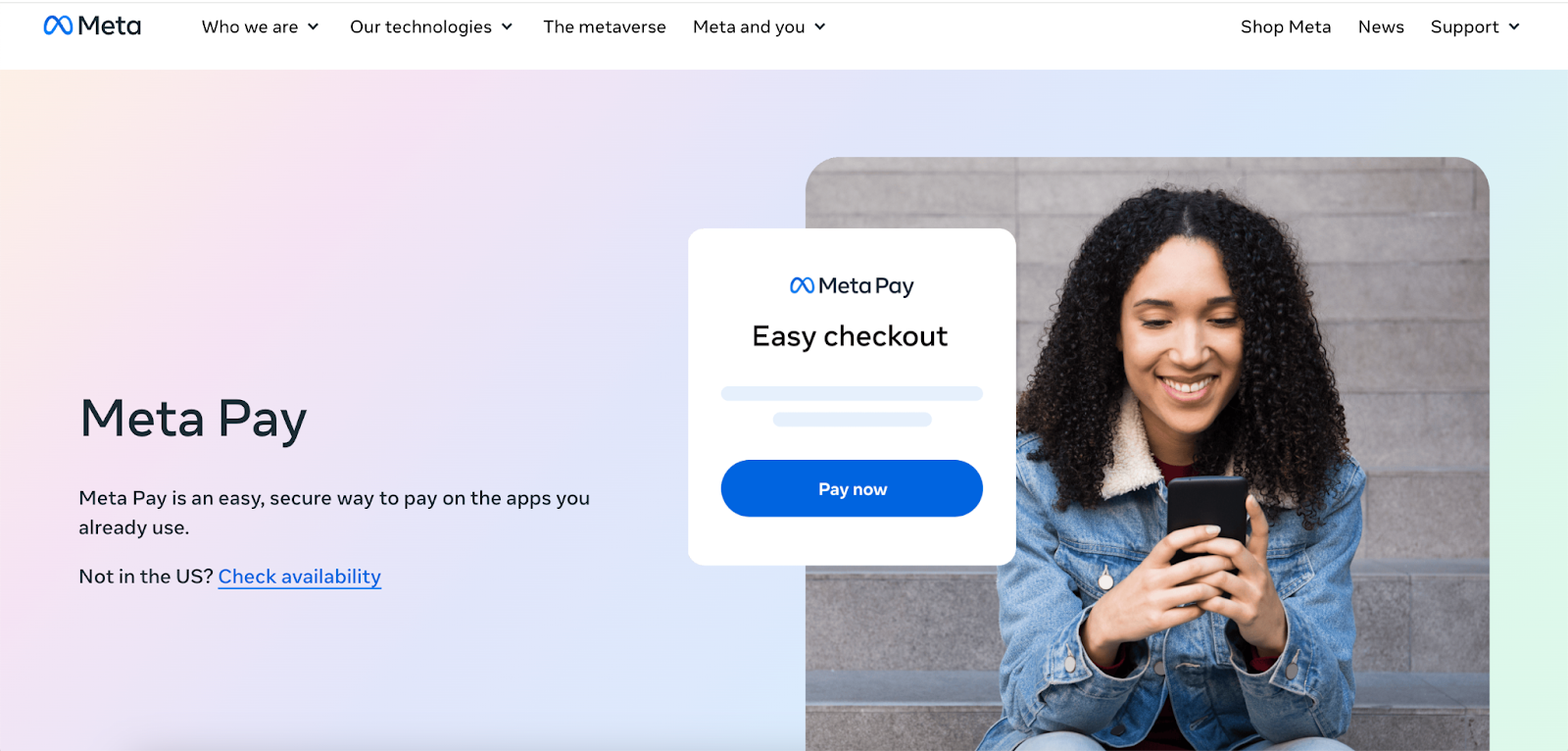

Meta Pay

Formerly known as Facebook Pay, Meta Pay is a payment gateway enabling customers to make payments using their mobile devices. However, its availability varies by country.

Processing Fees

Meta Pay does not impose any additional fees; you only need to cover the standard fees charged by your payment processor.

Accepted Payment Methods

Meta Pay supports most major credit and debit cards, along with PayPal and Shop Pay.

How to Configure Shopify Payments Step-by-Step

Before setting up Shopify Payments, decide on your store currency. This currency is used in your Shopify admin to price products and generate reports. Choose your store currency before making your first sale. If you need to change it later, you’ll have to contact Shopify Support.

Only the store owner can change the payment provider.

The information required to set up your Shopify Payments account depends on your store’s country. Check the list of requirements for each supported country to ensure you have everything you need.

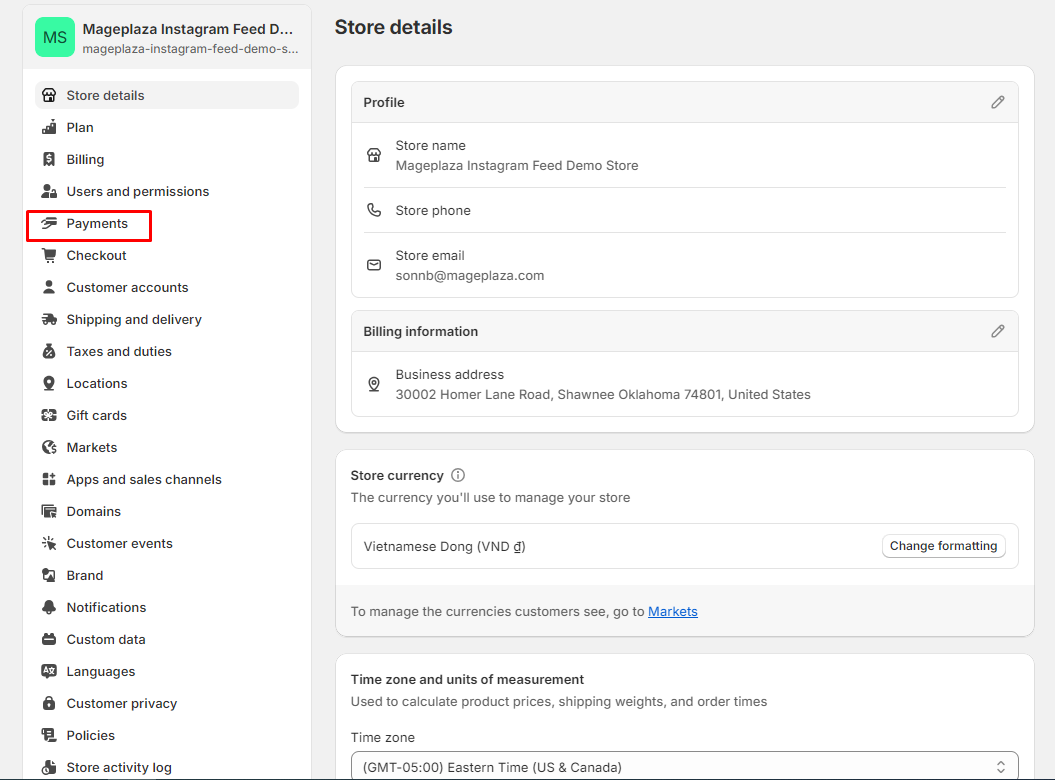

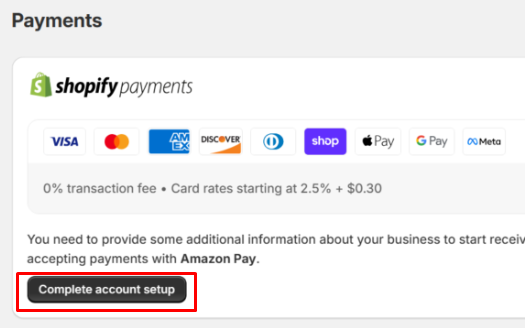

Step 1. In your Shopify admin panel, navigate to Settings > Payments.

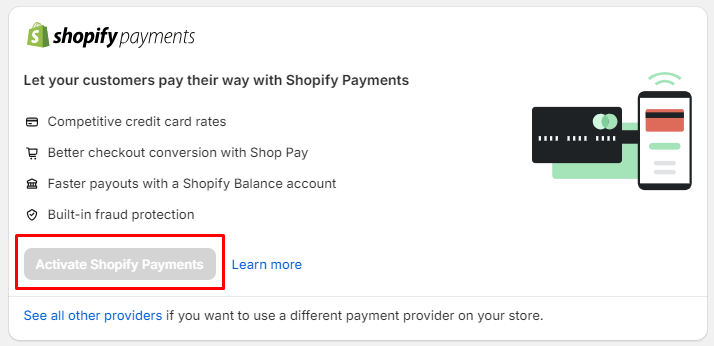

Step 2. Enable Shopify Payments using one of these methods:

- If no credit card payment provider is set up on your account, click Complete account setup in the Shopify Payments section.

- If another credit card payment provider is currently active, click Activate Shopify Payments in the Shopify Payments box, then confirm by clicking Activate Shopify Payments in the dialog. This will remove any existing credit card payment provider.

Step 3. Fill in the necessary information about your store. If eligible, a Shopify Balance account will be created for you; otherwise, you will need to provide your banking details.

Depending on your region or eligibility for Shopify Balance, you may also need to enable two-step authentication for your store.

Step 4. Click Save.

Conclusion

Shopify Payments is a valuable addition to your Shopify store, offering convenience and simplicity. It can decrease abandoned carts and cut expenses, ultimately increasing revenue. While it presents some challenges, its advantages outweigh them. Limited access may be a barrier for some, but alternatives exist. If possible, we strongly advise embracing Shopify Payments for its numerous benefits.