With a big catalog of 224+ extensions for your online store

How to Configure Value Added Tax (VAT) in Magento 2

Configuring Value Added Tax (VAT) from Magento 2 backend is a great solution in order to solve the conflict of the different VAT calculations, namely the store is located at different regions and the type of goods you provide are products, materials, or services. With VAT functionality, you can create the data management table that contains your country, VAT rate, customer types, and so on.

Configuring VAT in Magento 2 allows you to comply with existing rules, manage your cost better, as well as become more professional. Therefore, today, I want to show you all steps to configure and apply the VAT quickly on your Magento 2 store.

Configure Value Added Tax (VAT) in Magento 2:

- Configure Customer Tax Classes

- Configure Product Tax Classes

- Configure Tax Zones and Rates

- Configure Tax Rules

- Plus Tax Classes to Products

Configure Customer Tax Class

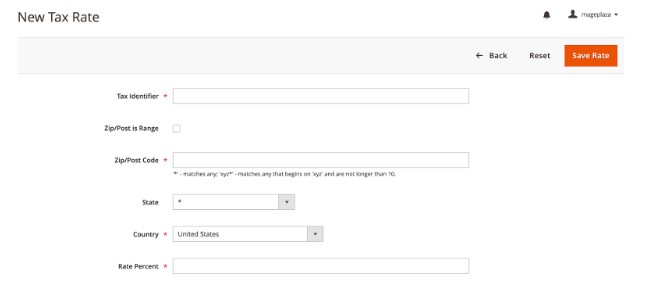

To establish a tax rule, you initially must incorporate a tax rate.

- Access the

Stores>Taxes>Tax Zones and Ratessection on the Admin sidebar.

If you already possess a customer tax class for VAT, skip the following steps; otherwise:

-

Select

Add New Tax Rate -

Input the

Tax Identifier -

Put a tick on the

Zip/Post is Rangecheckbox to specify the zip code range -

Specify the applicable country for the tax

-

Enter the

Rate Percent -

Upon completion, click on

Save Rate

Configure Product Tax Class in Magento 2

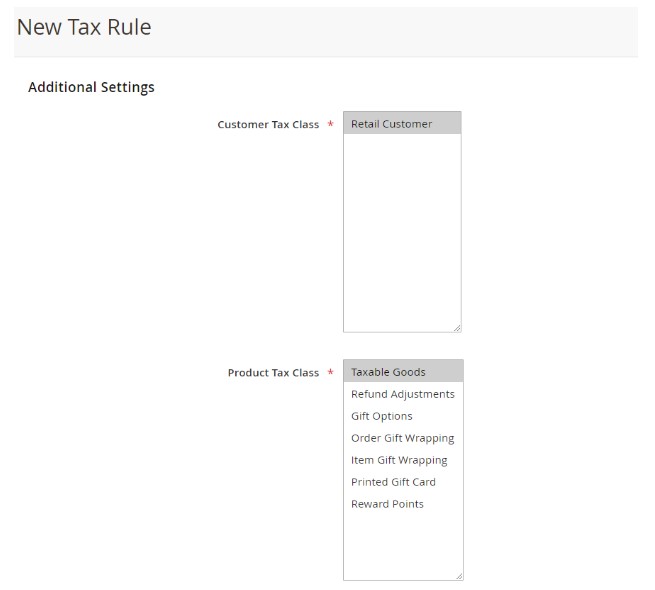

Go to Stores > Taxes > Tax Rules on the Admin sidebar.

If you already have a product tax class for VAT, you can skip these steps. Otherwise:

-

Select

Add New Tax Rule -

Expand the

Additional Settingssection -

Click

Add New Tax ClassunderProduct Tax Class -

rovide a Name for the new tax class.

-

Establish

VAT Standard, VAT Reduced, andVAT Zero, then clickSave Class -

Finally, click

Save Rule

Set Up Tax Zones and Rates

Access Stores > Taxes > Tax Zones and Rates on the Admin sidebar.

Choose Add New Tax Rate and fill in all the required information.

For instance:

VAT Standard

-

Tax Identifier: VAT Standard

-

Country and State: United Kingdom

-

Rate Percent: 20.00

VAT Reduced

-

Tax Identifier: VAT Reduced

-

Country and State: United Kingdom

-

Rate Percent: 5.00

After entering the details, click on Save Rate.

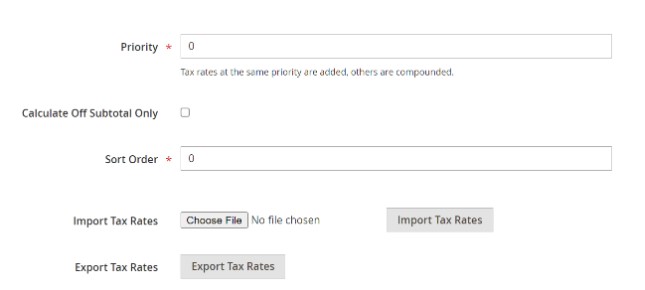

Configure Tax Rules

A tax rule is a combination of a customer tax class, a product tax class, and a tax rate.

Navigate to Stores > Taxes > Tax Rules on the Admin sidebar.

Add new tax rules and provide all the essential information as required.

For instance:

VAT Standard

-

Name: VAT Standard

-

Customer Tax Class: Retail Customer

-

Product Tax Class: VAT Standard

-

Tax Rate: VAT Standard Rate

VAT Reduced

-

Name: VAT Reduced

-

Customer Tax Class: Retail Customer

-

Product Tax Class: VAT Reduced

-

Tax Rate: VAT Reduced Rate

After entering the details, click on Save Rule.

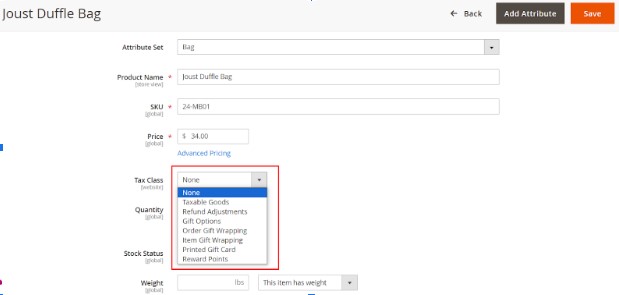

Plus Tax Class to Products

- On the Admin Panel,

Catalog > Products. - In the product list, find the needed product and open it in the edit mode.

- Set the

Tax Classto VAT Class that applies to the product. - Click

Saveto complete.

VAT is an essential part when conducting any type of business, and it may differ based on the locations or the product type. However, you can configure VAT in Magento 2 with ease following the above guide. Also, it is possible to add tax to the total price as an extra fee. If you need to read more about tax-related issues, we have the related links below for you. Any questions or comments can be added in the box and we will reply to it as soon as possible.

Common Mistakes To Avoid When Configuring VAT

1. Apply a One-Size-Fits-All Approach to VAT Rates

Value Added Tax (VAT) rates differ based on country, product category, and occasionally, customer classification (business-to-business versus business-to-customer). Setting up your Magento 2 store with a uniform VAT rate for all goods and services may result in inaccuracies in tax collection and reporting.

2. Disregard VAT Registration Limits

Each country has its own rules about when you need to start charging VAT. Make sure you know these rules and sign up for VAT when your sales go over that limit. If you don’t, you might get fined and have to pay taxes from earlier sales.

3. Ignore VAT Number Validation for B2B Sales

When selling to other businesses in places like the EU, checking if a customer’s VAT number is valid means they don’t have to pay VAT. If you forget to do this, it can make transactions more complicated and make businesses pay VAT when they don’t need to.

4. Fail to Update VAT Rates

Regularly updating VAT rates in your Magento 2 store is crucial due to the potential for changes. Failure to do so can result in incorrect charges, leading to customer inconvenience and damage to your business reputation through refunds or additional charges.

5. Not Set Up Tax Zones and Rates Accurately

Magento 2 enables the configuration of tax zones and rates based on customer addresses. An incorrect setup may result in applying the wrong tax rates, impacting compliance and eroding customer trust.

FAQs

1. Can I set up different VAT rates for different countries in Magento 2?

Yes, Magento 2 allows you to configure different VAT rates for various countries or regions based on your business requirements.

2. How to configure VAT for my Magento 2 store?

To set up VAT in Magento 2, refer to the step-by-step guide outlined in the article. It includes instructions for establishing customer tax classes, product tax classes, tax zones, rates, and tax rules. These adjustments guarantee the precise calculation and application of VAT in transactions.

3. What is the importance of VAT validation in Magento 2?

VAT validation in Magento 2 verifies the accuracy and validity of customer-provided VAT numbers during checkout. This process is crucial, particularly for B2B transactions, as it ensures correct tax exemptions are applied and helps Magento comply with VAT regulations.

4. How often should I update VAT rates in Magento 2?

It’s crucial to stay updated with changes in VAT rates and promptly update them in your Magento 2 store to avoid applying incorrect rates to customer orders. Regular monitoring and updating are recommended to maintain accuracy.

5. What effect does VAT registration have on my Magento 2 store?

VAT registration thresholds differ by country, necessitating registration once sales surpass the specified threshold. Neglecting registration can lead to fines and retroactive tax payments. Configuring appropriate VAT rates in your Magento 2 store ensures compliance with registration obligations.

Discover Mageplaza Extra Fee in Magento 2

Related topics

Looking for

Customization & Development Services?

8+ years of experiences in e-commerce & Magento has prepared us for any challenges, so that we can lead you to your success.

Get free consultantRecent Tutorials

Change Store Email Addresses

Fix Magento 2 'Invalid Form Key. Please refresh the page'

Magento 2 Search Settings: Default Magento vs Mageplaza AJAX Search

Explore Our Products:

People also searched for

- magento 2 vat

- magento 2 change tax to vat

- magento 2 uk tax

- magento 2 vat exemption

- magento 2 get tax rate by tax class id

- magento 2 tax

- magento 2 vat number

- magento 2 vat validation

- magento 2 uk tax rates

- magento tax

- magento 2 tax rules

- magento setup uk tax

- magento 2 get product tax class id

- magento 2 tax settings

- how to add tax in magento

- magento 2 uk

- vat validation magento 2

- magento 2 price including tax

- magento 2 tax configuration

- magento 2 set tax class programmatically

- 2.3.x, 2.4.x

Stay in the know

Get special offers on the latest news from Mageplaza.

Earn $10 in reward now!